Planning Your Journey Towards Retirement

Reading Time: 4 minutes

Planning for retirement can be difficult. Zoe’s Five Phases of Retirement splits your journey towards retirement into five distinct phases throughout your life.

Planning for Retirement Isn’t One Size Fits All

With a comfortable retirement being a universally desired goal, you’d think there would be more literature on how to achieve it. At Zoe Financial, we combed through mountains of academic papers, government demographic studies, institutional research, and more. Yet, we quickly found there is no single source of truth on planning for retirement. In fact, nearly every person searching faces the same conundrum. There is no clear way to understand how your financial decisions and habits will ultimately help you while planning for retirement.

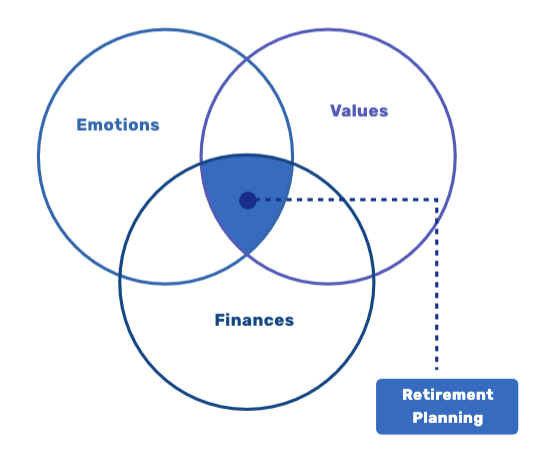

Part of the reason it is so challenging to find a clear guide to retirement is because how you approach retiring depends largely on how your emotions, values, and finances overlap. There is no “one-size fits all” approach.

When you draw your own path alongside a holistic framework, planning for retirement becomes far less ambiguous and can instead become second-nature. Instead of being a cause of stress, retirement becomes a pleasant journey instead of a race to the finish line.

Planning for Retirement At Any Age

Retirement used to mean you stopped working, but what people really mean when they think about retiring is having the financial independence to do whatever they’d like. Retirement doesn’t mean you stop working, rather it means you have the financial independence to not have to. That said, financial independence doesn’t come at the flip of a switch though. It’s something you actively work towards throughout the different phases of your life, regardless of age.

“What people really mean when they think about retiring is having the financial independence to do whatever they’d like.”

As Schwab’s research showed, many believe that simply saving throughout their lives will be enough. What traditional retirement planning often gets wrong is assuming that you should be following a certain savings “rule of thumb” at a particular age. However, the stages of your life aren’t dictated purely by age but rather on unique experiences that can’t possibly be summed up with a simple rule of thumb.

While some people think of retirement as an isolated dot on the map to be reached at a prescribed point, it’s more like an interconnected line in which each of those particular experiences (financial and otherwise) connect towards a goal. Preparing for retirement as an active journey instead of a single destination point can make it feel exciting, as opposed to nerve-wracking and burdensome. In order to plan for retirement holistically, begin by identifying which phase of your journey you’re currently at.

Planning for Retirement in Five Phases

Every individual’s emotions, values, and finances are unique. Zoe’s Five Phase Retirement Framework splits your journey towards retirement into five distinct phases throughout your life. This way, your retirement planning phase always aligns with your specific situation.

Phase 1: Earn

Retirement planning is often centered on the principle of “spend less, save more,” but this advice often falls short when retirement feels distant. Phase 1: Earn, discusses the value of maximizing your earning potential. The Earn Phase is most appropriate for individuals who are only just now setting off on their adventure into preparing for retirement and want to learn how to earn more, to save more.

Phase 2: Save

Once you’ve maximized your earning potential, Phase 2: Save, comes into play. Learn how to “find your sweet spot” in terms of saving. Additionally, discovering what kind of saver you are can make a big difference in your retirement foundation. The Save Phase is about how to ensure you’re approaching saving towards your retirement effectively by selecting the right retirement savings account (Employer-Sponsored Retirement Plan such as a 401k or 403b or an Individual Retirement Account IRA), all while keeping an eye out for lifestyle creep.

Phase 3: Grow

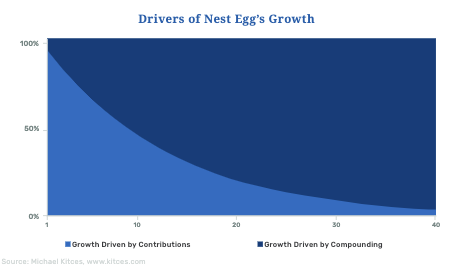

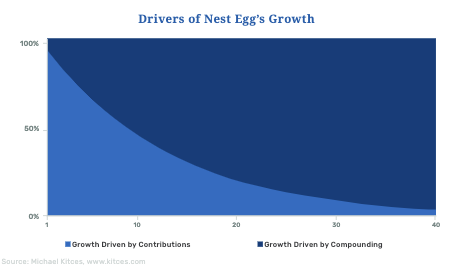

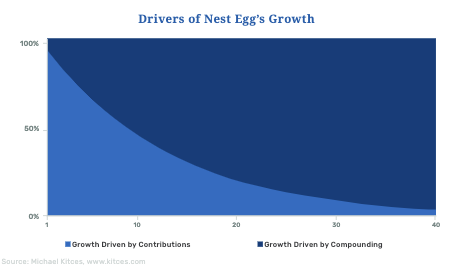

There comes a point when your monthly savings contributions just don’t make a substantial dent in your nest egg. This is when you need to switch gears towards Phase 3: Growth. The below chart looks at a nest egg’s growth driver over 40 years.

At first, it’s clear growth is driven by contributions, but as time passes, the account value is overwhelmingly driven by the compounding of your investments. The Growth Phase focuses on growing your wealth by allowing compounding to do the heavy lifting, understanding asset allocation, risk capacity and risk tolerance, tax implications, and being aware of potential underlying costs in your investment portfolio.

Phase 4: Transition

Traditional retirement planning often doesn’t include Phase 4: Transition, despite it being absolutely essential. In the Transition Phase, you’re dipping your toes into the retirement pool instead of diving in headfirst at a predetermined age. Your transition into retirement is the most inherently unique as it will depend on existing savings and investments, health conditions, income, and a multitude of other factors. A qualified wealth planner can be helpful during this phase, as they can help you avoid sequence of return risk and other costly mistakes as you begin phasing into retirement.

Phase 5: Preserve & Enjoy

Time to kick up your legs and enjoy! Phase Five: Preserve and Enjoy, provides essential strategies to ensure you don’t have to worry about your finances in retirement. Learn how to establish a realistic retirement income plan through frameworks including the Buckets System, Target Risk Portfolios, and Target-Date Funds. Additionally, in the Preserve and Enjoy Phase, you’ll want to understand required minimum distributions (RMDs), and how much/from which accounts you should withdraw to live off without being concerned about outliving your money or relying entirely on social security or pension.

In this series, we’ll dive deeper into each of these phases and how they relate to your unique retirement planning journey. To identify which phase suits you best at this point in your life, as well as to learn actionable frameworks and strategies, download your free copy of our latest cost-free guide, The Road to Retirement.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners