When I was a kid, the weeks leading up to the first day of school were the most exciting of the year. I remember hitting up the local mall with my mom, trying on cute jeans with the embroidered pockets, choosing the right ‘statement’ winter coat that screamed “She’s hip! But also warm…”. Trapper Keepers were purchased, notebooks labeled, pencils sharpened, bookbag stuffed. Seventh grade was about to begin and I was ready to hit it hard. Being organized is important for success in retirement as well, but there are several variables that are beyond our control that, without proper planning, can make or break retirement.

Here are four of the big ones:

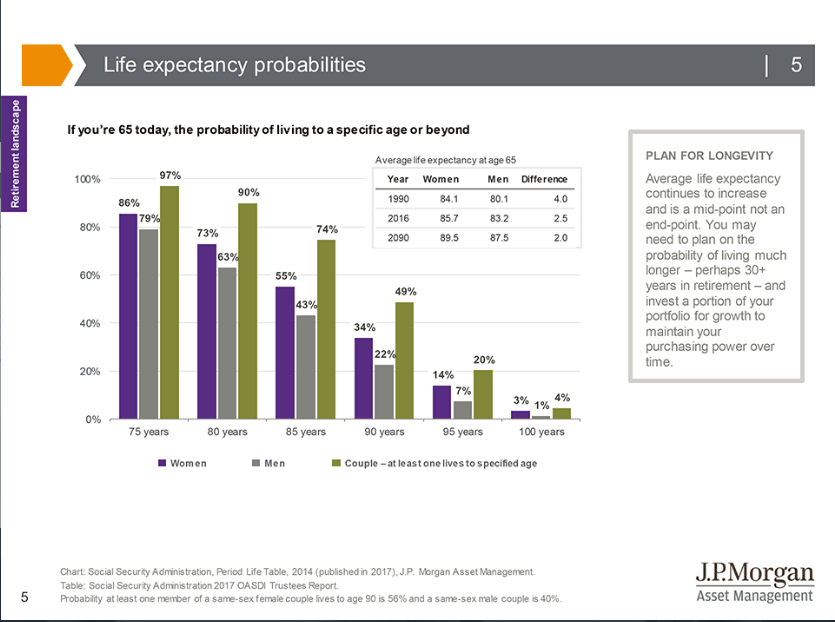

1. You might live longer than you think.

Life expectancy in the US is increasing, yet six in ten Americans underestimate our life expectancy. This means that 60% of us could live longer than we expect to—which is awesome if we are prepared for it—but a bummer if we reach age 90 and have $5 left in the bank!

The chart by JP Morgan below shows that:

- the average woman at age 65 today has a 55% chance of living to age 85

- Four in ten 65-year old men will make it to age 85

- There is a 74% chance that at least one person in a couple at age 65 today will make it to age 85

(and almost a 50% chance that one of them will live to 90!)

These numbers are averages, and most people should not plan for the average or midpoint, but to the ‘beyond,’ whatever that may be.

Consider the factors that help determine life expectancy: family history of longevity or illness, your own lifestyle including exercise, diet, mental health, and smoking habits. Also, keep in mind that more educated and higher income individuals tend to have longer life expectancy than the average; this group tends to have better health habits, doesn’t smoke, lives in ‘healthy’ areas of the country and has better access to health care.

2. How much do you need for retirement?

Most experts agree that in order for Americans to maintain a similar lifestyle in retirement, they will have to budget for 70-80% of their pre-retirement spending. If your average pre-retirement income was $100,000, you would generally need about $75,000 a year to have an equivalent lifestyle in retirement (this amount includes any Social Security benefits)

Spending in retirement varies. In “The Prosperous Retirement: Guide to the New Reality,” author Michael Stein identifies the three phases of retirement.

- During the early ‘go-go’ years when we are healthy and newly retired, many people spend more than they may have expected to, in some cases surpassing their pre-retirement spending.

- Next come the ‘slow-go’ years when people slow down, travel and entertain less and experience health problems; spending begins to slow.

- Finally, come the ‘no-go’ years when older retirees spend less in most categories but may see a spike in health care costs or experience an extended long-term care event.

Considering some of the variables in retirement—longer life expectancy, unexpected health care costs, long-term care events, etc.– it’s really important at this stage of your life to hone in on a solid plan on your own or to work with an advisor to create a tailored plan to help you navigate these uncertainties.

3. Health care costs are likely to grow in retirement.

One of the biggest costs for individuals in retirement is health care.

In fact, health care has been the fastest growing retirement cost over the past few decades (although the year-over-year inflation rate in recent years has been low). Most individuals sign up for Medicare benefits at age 65; however, Medicare does not cover all the costs of healthcare so most people purchase supplemental plans. These supplemental plans may continue to increase in cost over time and could drive overall health care costs to more than triple for an individual in retirement over the next few decades. Long-term care events—which are more likely to occur after age 80– may also drive costs higher.

While we can’t control how much health care costs will increase in retirement, we can control how much we save and make sure to invest in a diversified portfolio of stocks and bonds. Taking a disciplined approach to saving and investing can help prepare individuals for many retirement road bumps.

4. You can’t time the market, and in many cases, your retirement!

In most things in life, timing is everything, and this is especially true when it comes to retirement. An individual may feel confident that he/she has saved enough, but if retirement coincides with a lengthy bear market, the early years of a down market could devastate a retirement portfolio; this is called sequence of return risk.

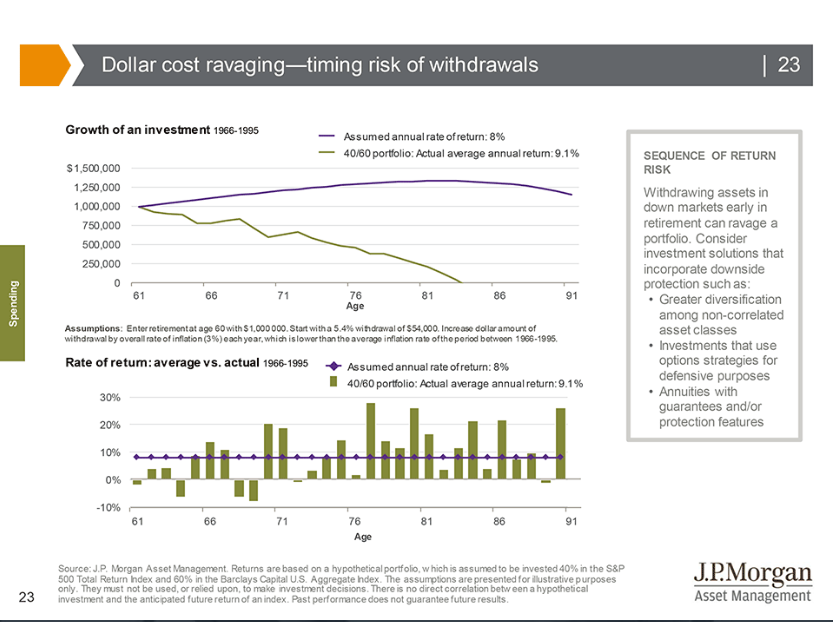

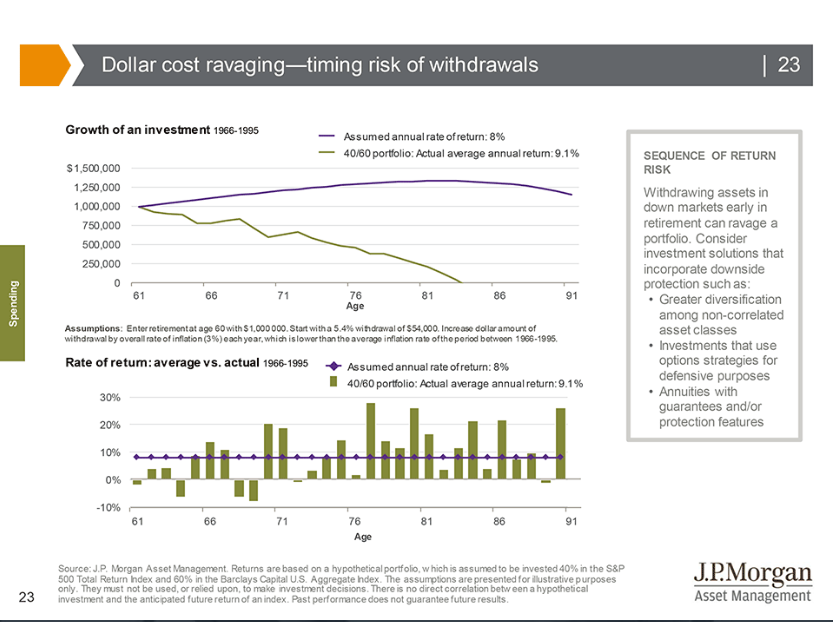

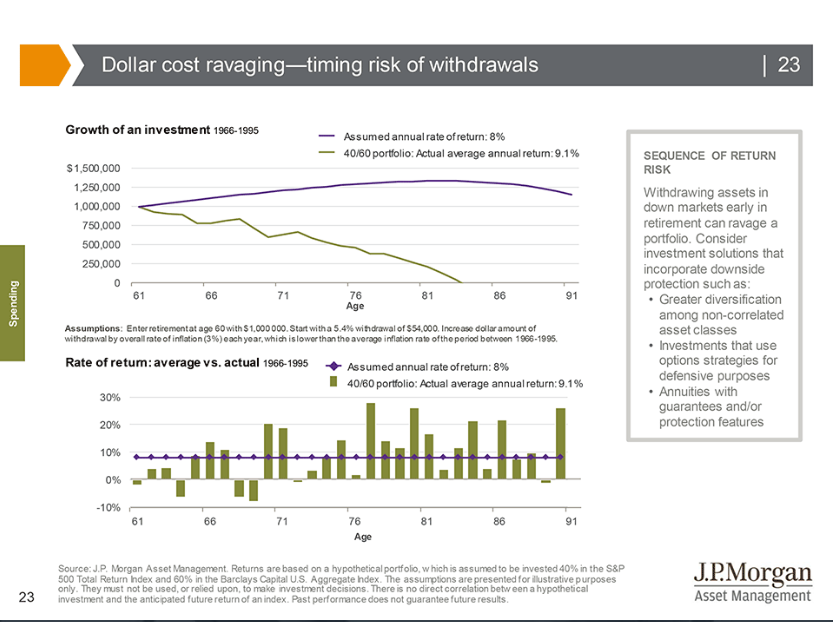

Consider the top chart below that shows an actual 8% rate of return over a 30+-year retirement (purple line).

This return seems to be sufficient for the portfolio to last throughout an investor’s retirement. But the green line shows the reality- that by taking an annual 5% withdrawal (adjusted for inflation), the individual runs out of money in his/her early 80’s because of poor returns in the first few years of retirement, as reflected in the bottom chart.

Some of us may not have a choice as to when to begin retirement, so saving early and investing savings in a well-constructed portfolio may provide the cushion and diversification necessary to weather the storm.

In conclusion, as the great investor Howard Marks has said “you can’t predict, but you can prepare.” Nothing in life is certain, but should consider likely scenarios and prepare for them. Either make your own plan or work with a financial advisor who can help you develop a plan to save and invest, and review your plan frequently as laws, life, and goals change.