Do’s and Don’ts of Tax-Loss Harvesting

Reading Time: 3 minutes

Tax-loss harvesting, meaning offsetting capital gains with capital losses, is a tax strategy wealth managers use to position your portfolio better while lowering your tax bill.

Tumbling stocks often leave investors running for the hills, but worry not – there is a silver lining to stock losses. The benefit of market volatility is the opportunity to harvest some losses!

Tax-loss harvesting, meaning offsetting capital gains with capital losses, is a tax strategy wealth managers use to position your portfolio better while lowering your tax bill. It is only possible when there are capital losses to be taken. While the market goes up over time, occasional dips are natural and can work to one’s benefit. Unfortunately, many investors who attempt to implement this strategy fall into the trap of only looking at tax-loss harvesting opportunities at year-end, when taxes are on their minds—waiting until December means missing out on opportunities over the year. The first best practice of tax-loss harvesting is taking advantage of dips in the market.

Let’s reflect on how the stock market performed in 2020. Over the year, the US stock market had positive returns, but in March 2020, it was down nearly 30%. If you had waited until December to try to tax-loss harvest, you likely wouldn’t have anything to sell at a loss, but if you looked in March, you would have had plenty of opportunities. If you’re interested in exploring the possibilities that tax-loss harvesting offers, there are a few do’s and don’ts to keep in mind.

Top 3 Tax-Loss Harvesting Tips

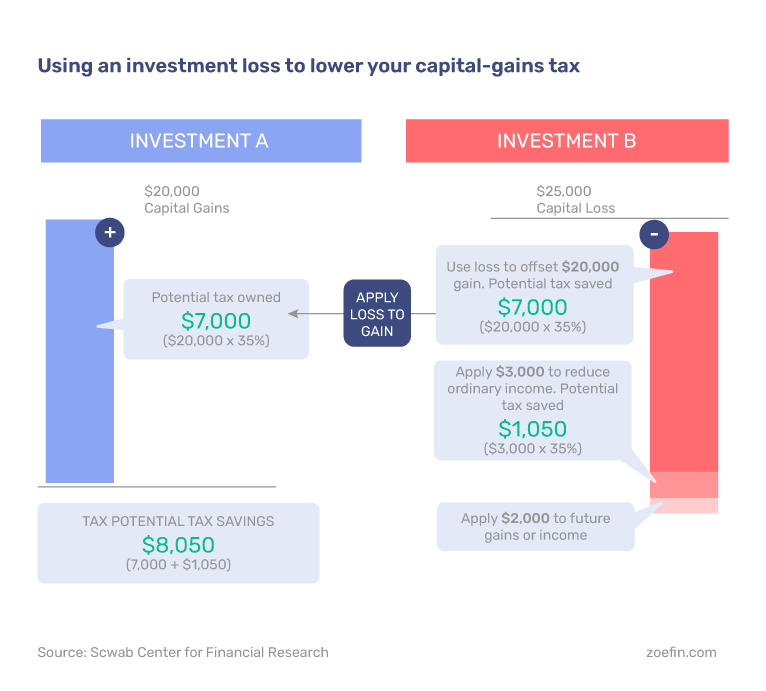

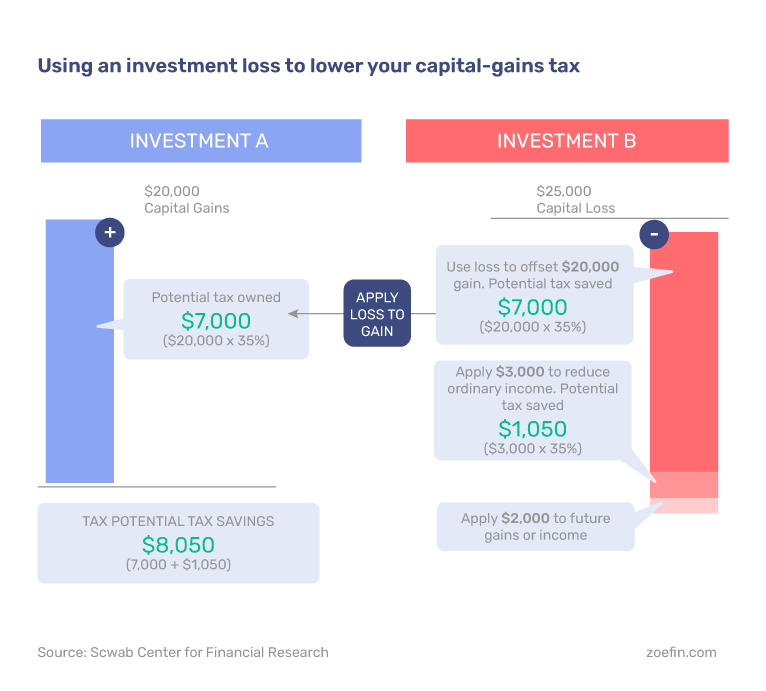

Using tax-loss harvesting to lower your tax bill can help you make lemonade out of lemons. As shown in the chart below, you can reduce your tax liability by offsetting capital gains with losses. In the example, an individual who could have potentially owed taxes of $7,000 on $20,000 investment, they can offset those losses and ultimately save up to $8,050 on taxes.

Do: Create a tax-efficient portfolio to save your money.

While taxes can never be eliminated, there are tax-efficient investing strategies that will close the gap between pre-tax returns and after-tax returns. Tax-loss harvesting is selling a position and using that loss to offset other realized gains or up to $3,000 of income. That loss can be carried forward indefinitely. Ultimately, it ensures that every loss has value.

Do: Stay Disciplined.

Many investors struggle with selling a position they chose at a loss because it feels like they are letting go of their money. Keep in mind that you are creating “artificial losses” and reinvesting any money sold at a capital loss. Other investors may find it very easy to sell at a loss because they simply are not comfortable with market fluctuations. However, those investors then struggle with getting that money reinvested. This strategy only benefits you if you stay disciplined and stick with your appropriate asset allocation (mixture of stocks, bonds, and cash).

Do: Use Tax-Loss Harvesting to lower your tax bill!

This can be time-consuming, but the value can be well worth it. The average investor is losing 1-2% per year due to taxes. Tax-loss harvesting is one of the most impactful tax management strategies there is. Consider what an extra 1% every year for 20 years would mean for you. Compounding is key in investing!

However, for tax-loss harvesting to truly benefit you, review your investment strategy, have a reinvestment plan, and beware of the wash-sale rule. Keep in mind that you do not need to do this alone. Top wealth advisors have research and processes to create the best possible after-tax return for their clients.

Tax-Loss Harvesting: 3 Things to Avoid

Putting a tax-loss harvesting strategy into action is straightforward; however, there can be significant drawbacks if not done well. The top three things to avoid when harvesting your tax losses include letting taxes drive your investment strategy, selling without a reinvestment plan, or triggering the IRS’ wash sale rule.

Don’t: Let taxes drive your investment strategy.

Taxes can significantly impact your investments, but they should never be the deciding factor. Your financial plan and risk tolerance are the foundation in determining your investment strategy while managing taxes is the bonus of a good investment strategy. Consider each specific investment and your long-term goals before selling.

Don’t: Sell without a reinvestment plan.

Before selling that position at a loss, you should know how you want to reinvest! First, don’t sell just for the sake of selling. The critical component to tax loss harvesting is that you stay invested in the market. There is no value to selling a position at a loss just to let it sit in cash. Selling a position at a loss will benefit you from a tax standpoint, but you need to reinvest that money back into the market for your portfolio to grow. As long as the money is reinvested in a suitable investment, you will be present and participating when the market eventually rebounds.

Don’t: Trigger the wash sale rule.

Beware of the IRS “wash sale rule.” This rule states that your loss will be disallowed if you reinvest in the same or a “substantially similar” investment 30 days before or after the sale. It’s important to note that you cannot get around the wash-sale rule by selling an investment at a loss in a taxable account and then buying it back in a tax-advantaged account.

Also, the IRS has stated it believes a stock sold by one spouse at a loss and purchased within the restricted time period by the other spouse is a wash sale. If your purchase gets identified as a wash sale, you can’t use the loss on the sale to offset gains or reduce taxable income. But, your loss is added to the cost basis of the new investment. Basically, you want to buy a security or fund that is similar enough to provide similar returns but not too similar that the IRS recognizes it. While it may seem a bit ambiguous, an advisor can help you navigate the grey area on triggering the wash sale rule.

The Benefits of Tax-Loss Harvesting

By creating a tax-efficient portfolio, staying disciplined, and using tax-loss harvesting to lower your tax bill, you put yourself in a better position come unexpected shifts in the market. While market volatility is to be expected, the way you manage your gains and losses can make a difference in your financial well-being. Since a tax-loss harvesting strategy can become time-consuming and has ambiguous triggers, like the wash sale rule, be sure to avoid letting taxes drive your investment strategy or selling without a game plan for reinvestment.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners