A Brief Guide to Equity Compensation

Written by:

Paul Horn, CFP® , CPWA®

Zoe Network Advisor

A Brief Guide to Equity Compensation Types

Published January 27th, 2023

Reading Time: 8 minutes

Written by:

Paul Horn, CFP® , CPWA®

Zoe Network Advisor

We live in a world that admires hard workers. As we grow up, we try our best to get into the best universities, graduate with honors, and have a solid start to our careers. We dream about having a job with a big title and everything that comes with it; financial liberty, luxurious trips, more time with loved ones, experience, accomplishments, etc. Among the essential things we tend to disregard are executive compensation types, including employee stock options.

We live in a world that admires hard workers. As we grow up, we try our best to get into the best universities, graduate with honors, and have a solid start to our careers. We dream about having a job with a big title and everything that comes with it; financial liberty, luxurious trips, more time with loved ones, experience, accomplishments, etc.

However, do we know how to maximize the benefits of hard work? Among the essential things we tend to disregard or misunderstand is executive compensation. More specifically, equity compensation is a great tool to grow wealth.

Here are some insights into the different types of compensation that may be available to you and how to take advantage of the benefits offered.

Some Helpful Terms

Before getting into the weeds of three basic forms of stock options that we will review today, let’s review a few terms:

- Grant Date: The date you are given the shares.

- Vest Date: The date your stock options become available to sell the stock options.

- Exercise Date: The date stock options are exercised (you get the right to buy or sell the stocks).

Restricted Stock Units (RSUs):

Restricted Stock Units (RSUs) are the most common form of stock options available these days. Companies favor these types of stock compensation because they don’t require the underlying stock on the balance sheet. In addition, RSUs are offered on a vesting schedule typically over four years.

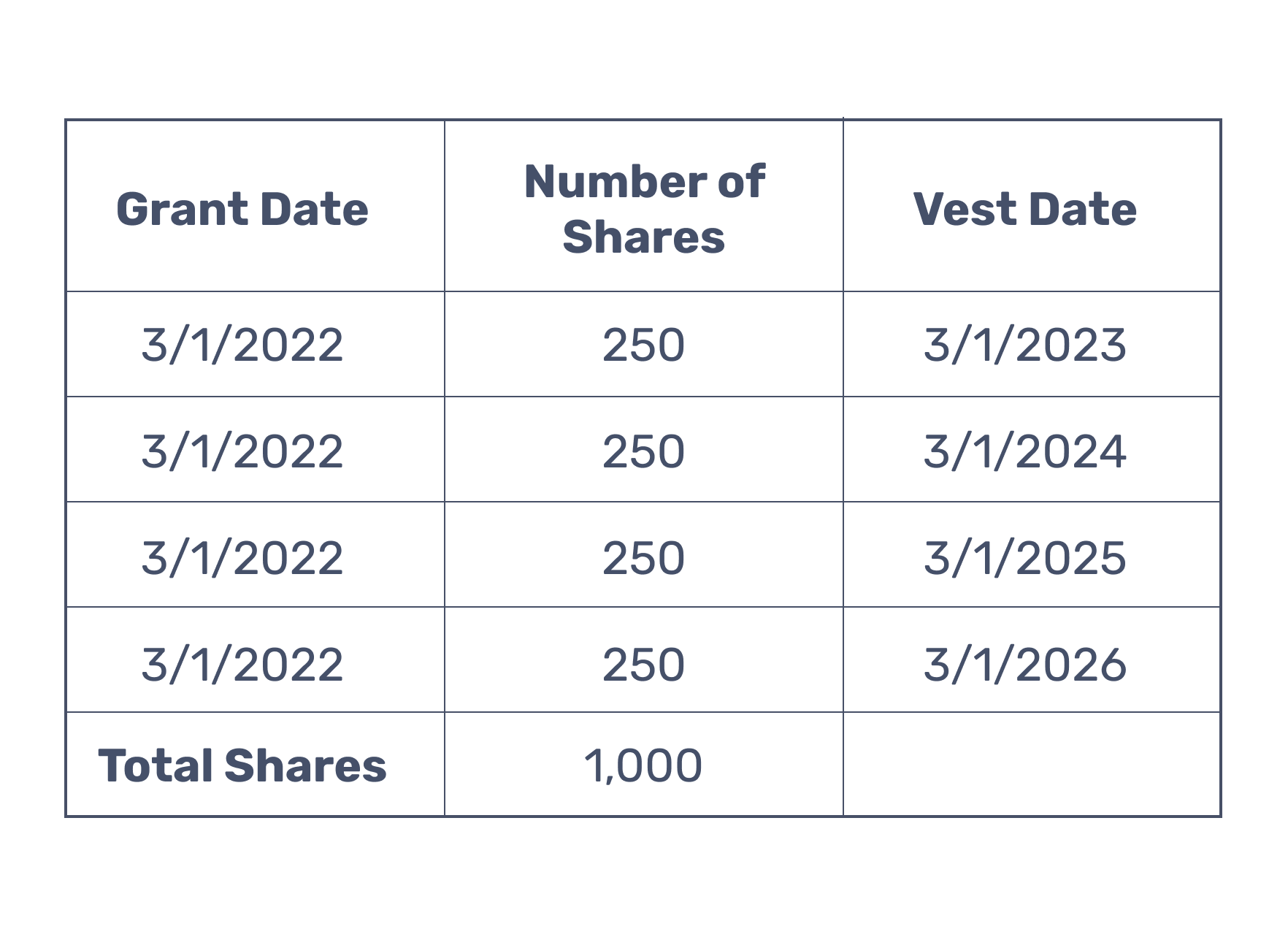

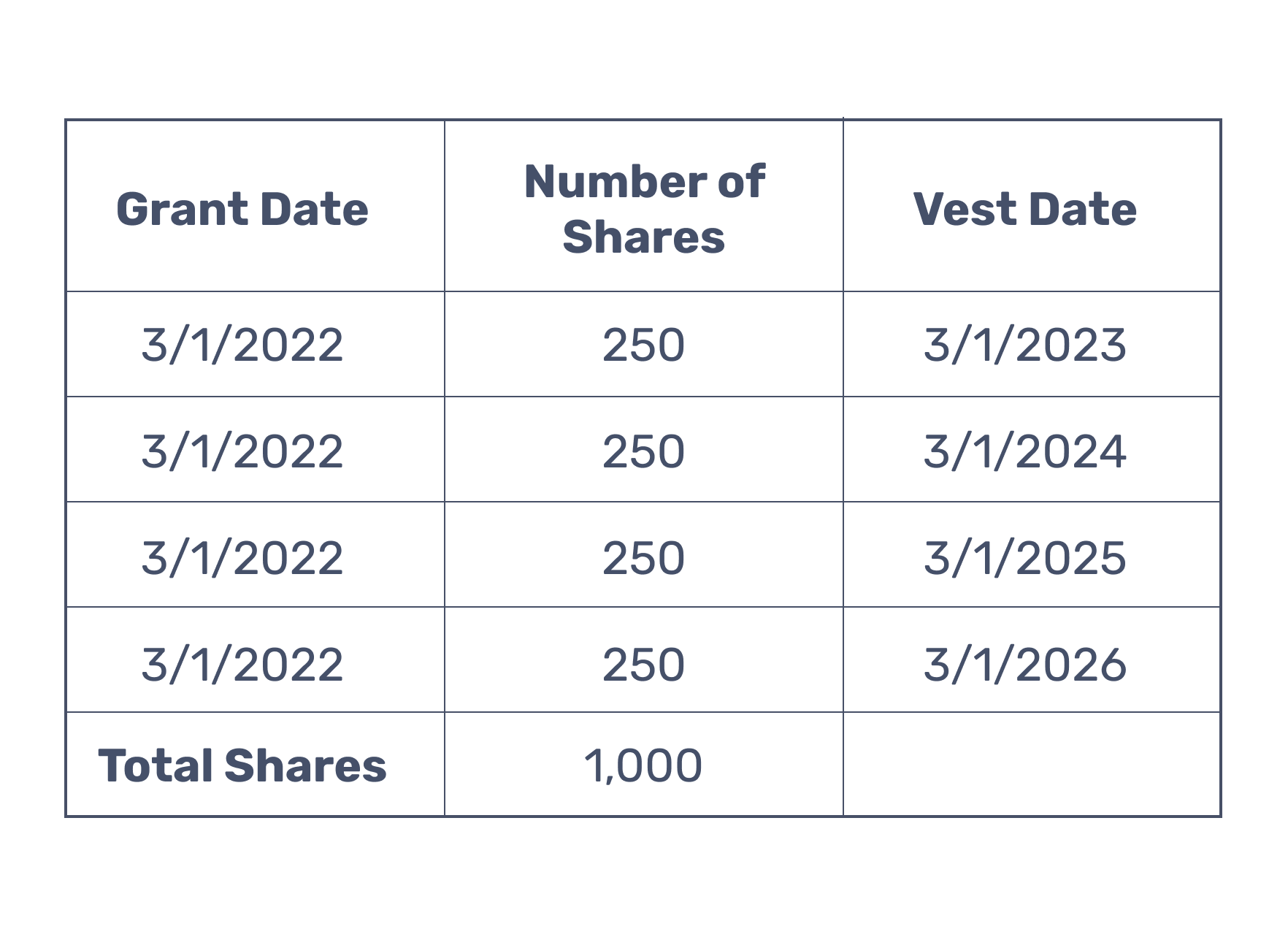

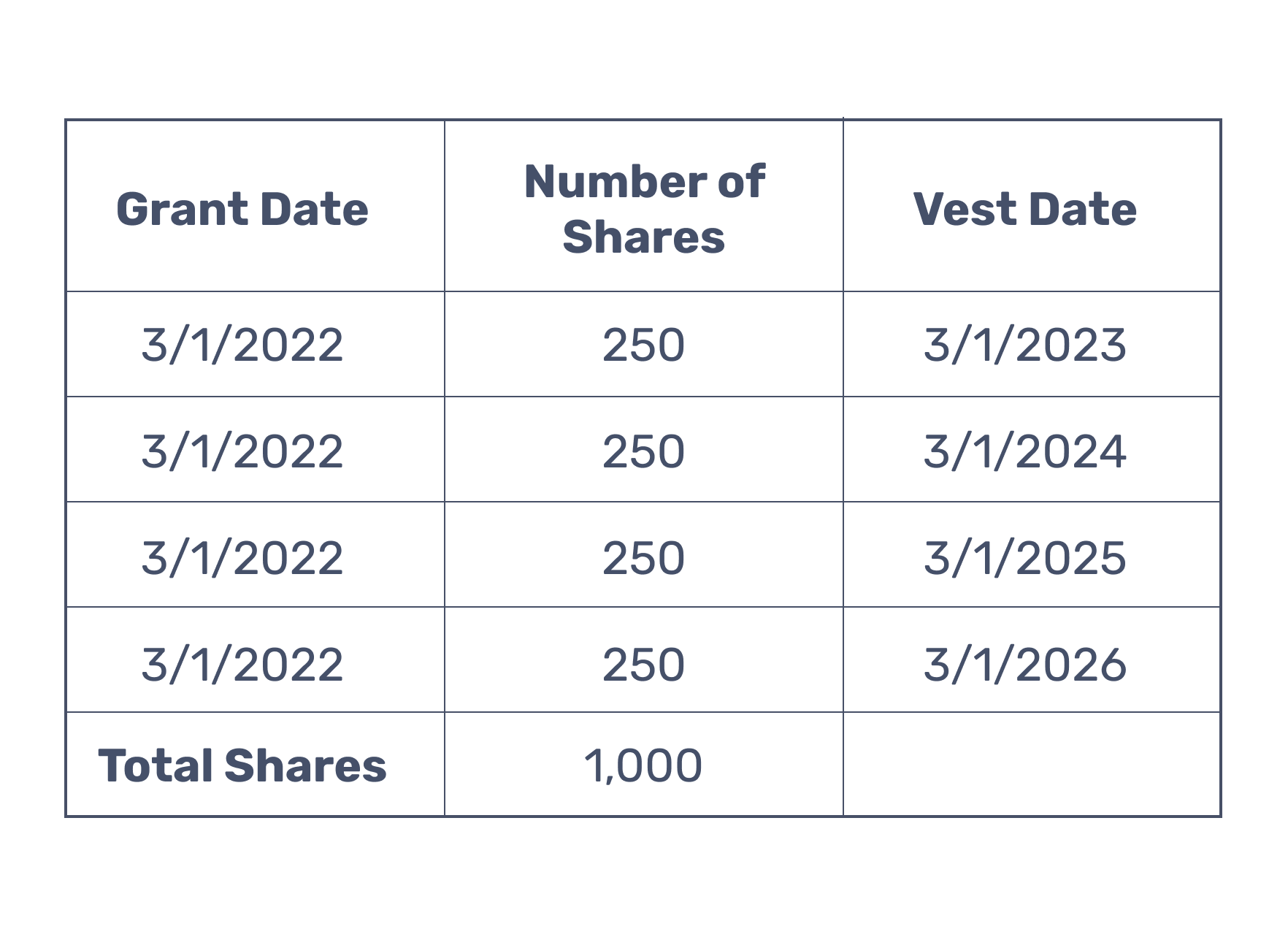

Let’s assume a company offers 1,000 shares of Restricted Stock that vest 250 shares per year over four years.

As the shares vest each year, the value of the shares is taxed as ordinary income. Let’s assume the stock price is $100 a share on 3/1/23. The employee is then subject to $25,000 (250 shares * $100 per share) in additional taxable income for 2023.

After the stock vests, the employee can take cash and subtract the amount held for taxes after they sell the stock, or they can keep the shares and let them grow over time. It’s generally best to treat RSUs as a cash bonus and sell all the shares, since this is how the IRS treats them from a tax perspective. Then, the money earned can be reinvested to allow for better diversification.

Tips for RSUs

- Treat RSUs like a cash bonus and exercise (sell) them in the same year they vest. You can then reinvest the cash into other investments.

- If you hold the stock after it vests, wait at least one year to take advantage of long-term capital gains tax rates.

- Try to negotiate for non-qualified stock options or incentive stock options to receive a more favorable tax treatment of your stock options.

- You will lose any unvested RSUs when you leave the company.

Non-Qualified Stock Options (NSOs)

Non-qualified stock options (NSOs) work similarly to RSUs, where you receive a specified amount of stock options that vest over time. However, a key difference is how the NSOs are taxed. The NSOs have a stock price called the exercise price that is determined at the time the grant is received.

Unlike RSUs that trigger taxes at the time they vest, NSOs allow the employee to determine when the taxes are triggered. This is done when they exercise the stock options, and the difference between the exercise price and the actual stock price is the amount subject to income taxes.

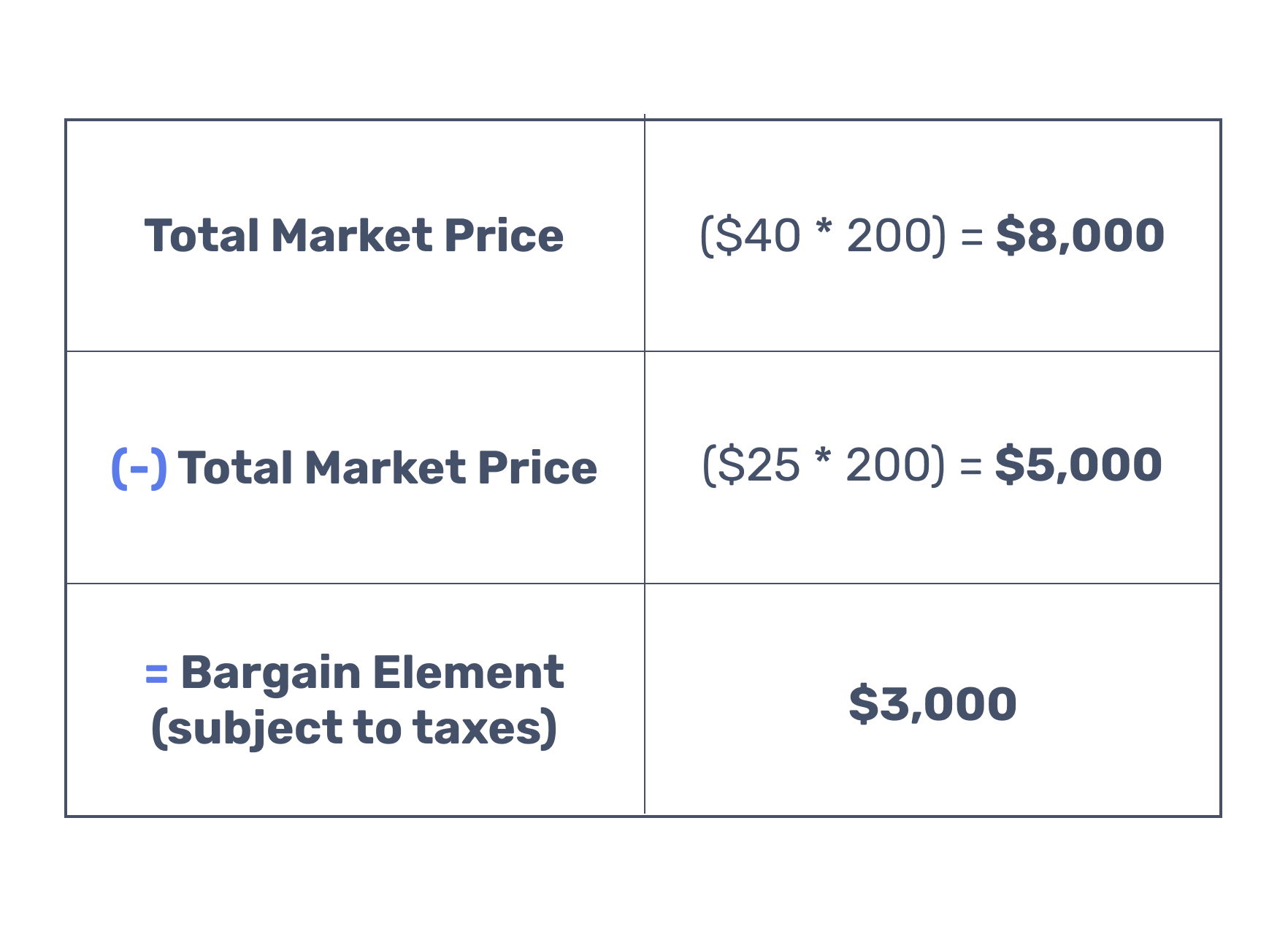

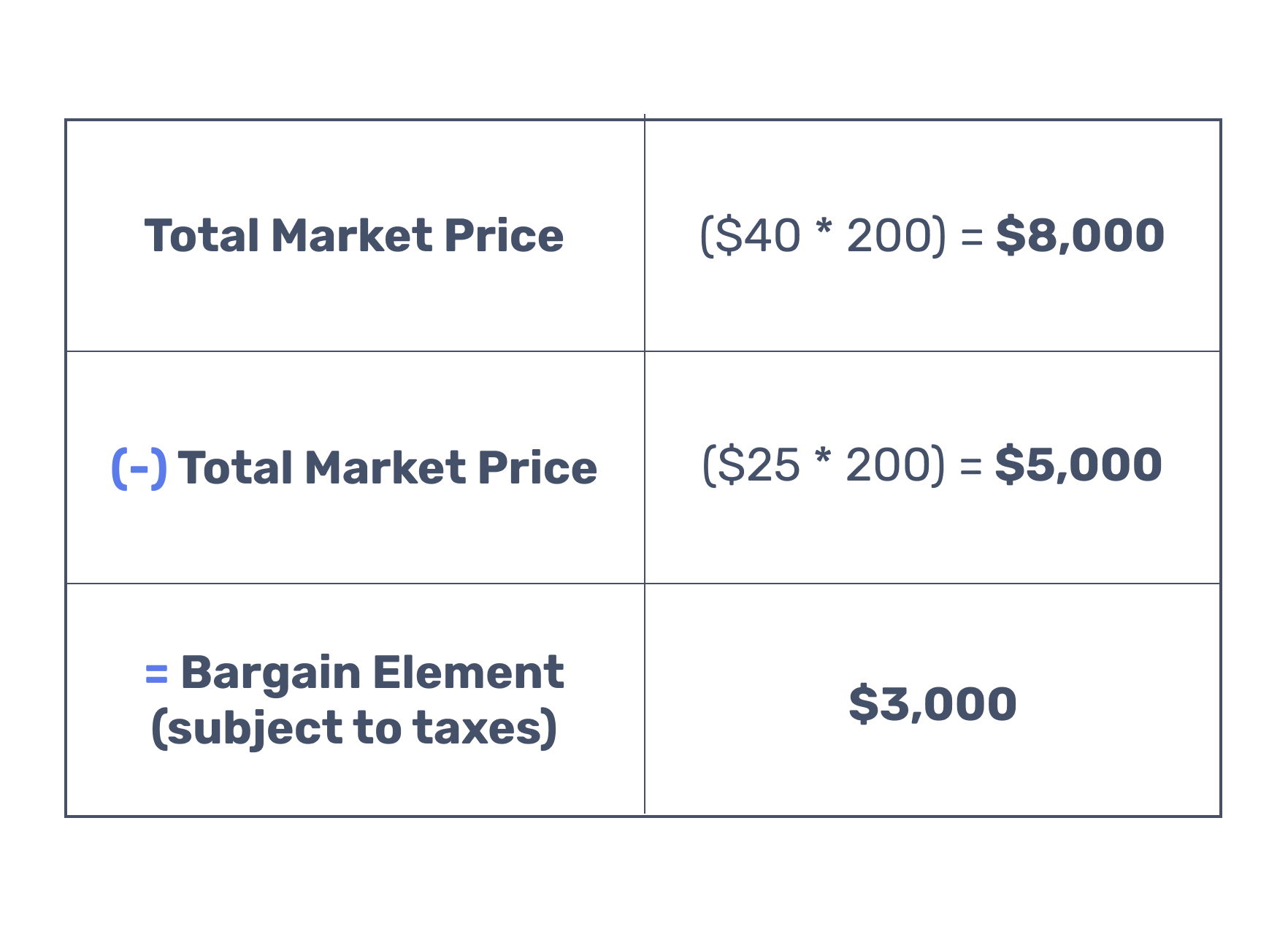

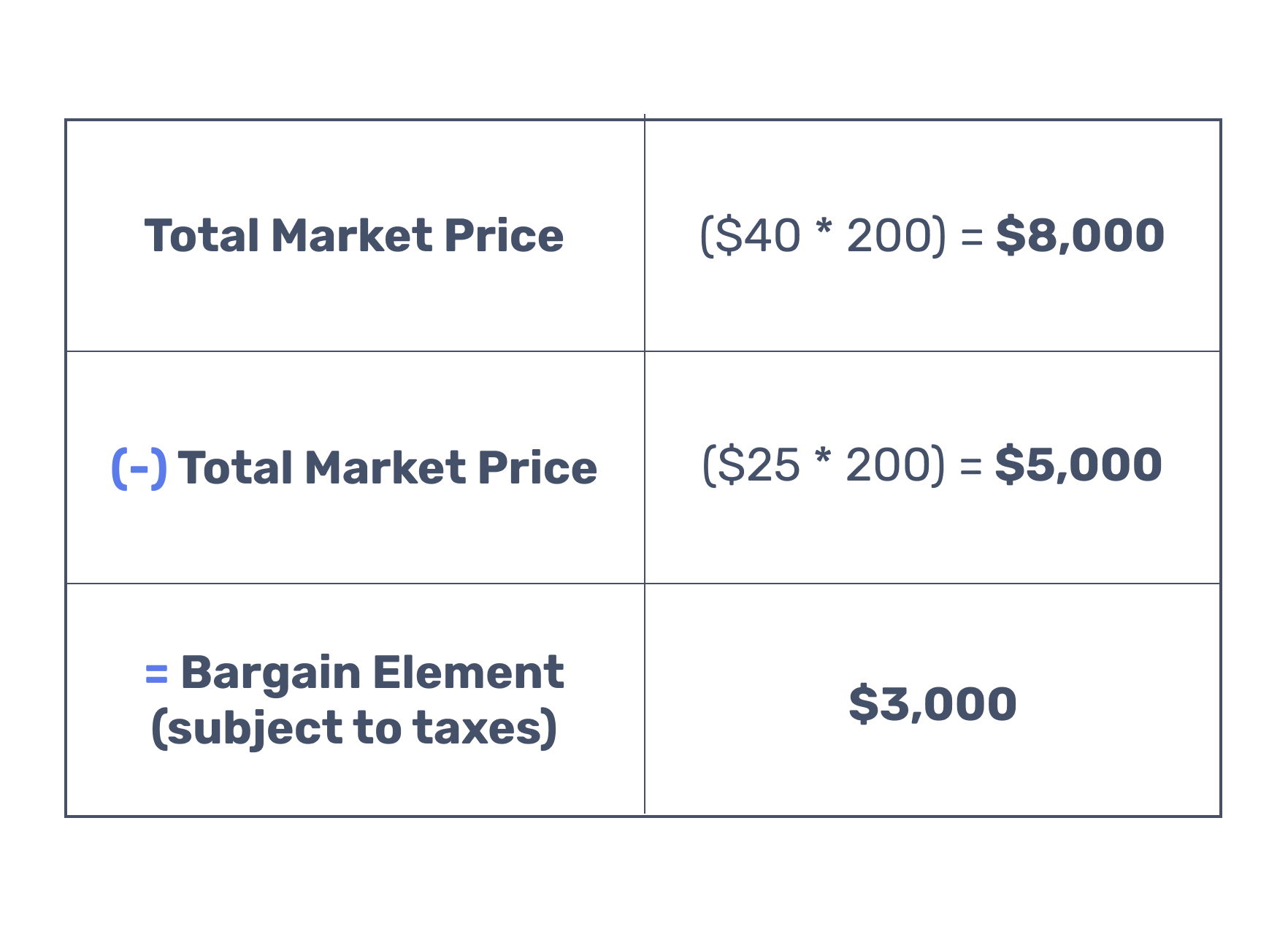

Assume that 200 shares have vested in ABC stock. The exercise price on the stock is $25, and the current market price is $40. Below is how we calculate the amount subject to taxes.

Non-qualified stock options are more favorable for the employee than RSUs. The employee has a specified period (typically ten years from the date of grant) that they can choose to exercise the stock options. When they exercise, you can take the cash minus taxes or hold the shares. With NSOs (and ISOs, which we cover next), you can choose an 83(b) election that triggers taxes in the short term but can lower taxes over the long term. An 83(b) election has to be made when you receive the stock options (at the date of grant) and essentially requests the IRS to recognize income on the stock options now.

By paying income taxes on the grant when you receive them, you switch the growth of the stock options from the income tax rate to the lower long-term capital gains tax rates.

Tips for NSOs

- Any NSOs not exercised when you leave the company will be lost.

- You can wait until the deadline (which can be as long as ten years) to exercise. This provides more flexibility from a tax perspective.

- When you exercise the stock option, you can take the stock or cash. However, if you choose to hold the stock, it’s best to wait at least one year to sell it and take advantage of long-term capital gains.

- Get insights from an expert to see if an 83(b) election is right for you.

Incentive Stock Options (ISOs)

The unicorn of stock options is Incentivized Stock Options (ISOs). These are the most favorable for an employee from a tax perspective. There are many rules around ISOs, which are common for employees working for start-ups in the tech space.

Since it’s difficult for them to compete for talent with the bigger names in the tech space, they have relied on ISOs as a critical differentiator to attract top talent. For most, ISOs work similarly to NSOs, where you pay taxes on the bargain element. However, the key difference is that with ISOs, you pay no taxes at the time of exercise and get more favorable tax treatment at long-term capital gains rates, if you meet certain requirements.

To get preferential tax treatment:

- You must hold the stock for at least two years from the date of the grant

- You must keep the stock for at least one year from the time of exercise.

Let’s take a look at the same example as the NSO above. We see the same $3,000 amount is subject to taxes. The difference is that the $3,000 for an NSO is taxed as income (highest rate is 37%) while for an ISO the $3,000 is taxed as capital gains (highest rate is 23.8%).

It’s imperative that you work with a Certified Financial Planner™ when working with ISOs. Aside from the complex holding period requirements, there are also additional requirements. For example, on the date you exercise (not sell!) the options, you trigger potential Alternative Minimum Tax (AMT) issues.

The IRS also limits individuals to $100,000 in ISOs annually. Any amount exercised over $100,000 loses ISO treatment and is taxed like an NSO. Careful planning is required for ISO treatment, and you must remember this if you are considering switching employers.

Tips for ISOs

- Hold ISOs for at least two years from the date of grant, and at least one year from the date of exercise to get preferred tax treatment.

- It may be beneficial to intentionally trigger the NSO tax treatment for some ISOs (for example, leaving your current employer for a better position). A Certified Financial Planner™ or tax professional can help you understand and implement this strategy if necessary.

- In a down stock year, working with a professional and maximizing how many options to exercise is beneficial.

- Work with an expert to see if an 83(b) election makes sense since it can lower your AMT tax burden.

Employee Stock Purchase Plan (ESPP)

While technically, this isn’t specific to executive compensation, ESPPs are an essential benefit offered by many employers that is underutilized and misunderstood. An employee stock purchase plan (ESPP) allows employees to purchase their employer’s stock, typically at a 5% – 15% discount. So, for example, if the stock is $20 per share and the company offers a 10% discount, the employee pays $18 per share. Additionally, they’ve had a $2 gain on the stock from day one. Typically, these stock purchases are made via payroll deductions like other benefits.

Participating in an ESPP can be an important strategy to accomplish your financial goals. For example, getting a discount on your stock purchase and holding it so it can appreciate over time is a good strategy to accumulate wealth.

The taxes on ESPP plans can be complex since not all plans are the same. The discount is taxed as ordinary income at the time of purchase. You will then pay taxes on the stock gains when you sell it (either short-term or long-term capital gains tax, depending on your holding period).

Tips for ESPPs

- ESPPs are a great way to accumulate wealth over time.

- Perform cash flow planning to help determine how much to contribute to an ESPP. You don’t want to save so much that you have trouble paying monthly bills.

- Be aware of stock concentration risk. We all remember Enron and the employees whose stock ended up being worthless.

The Bottom Line

Whether you are evaluating offered RSUs, NSOs, ISOs, or ESPPs, make sure you understand how to plan for taxes. This can be your advantage in a world of overachievers and hard workers. As an executive, you can maximize these benefits and reduce dependency on external factors to grow your wealth.

Important Disclosure Information: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Benefit Financial Services Group [“BFSG”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various

factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from BFSG. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. BFSG is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the BFSG’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request. Please Note: BFSG does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third

party, whether linked to BFSG’s web site or blog or incorporated herein and takes no responsibility for any such content. All such information is provided solely for convenience

purposes only and all users thereof should be guided accordingly.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners