Market Timing vs Time in the Market

Updated June 27th, 2024

Reading Time: 4 minutes

Though these terms may sound similar, market timing is not the same as time in the market. What do these mean, and which is a sounder investment strategy?

Let’s take a poll. Raise your hand if you’ve ever heard someone brag about how they bought Amazon stock right before its share price doubled. Warren Buffett once said, “The only value of stock forecasters is to make fortune-tellers look good.” The short-term direction of stock prices is close to random. But why? It all comes down to human psychology and the relationship between markets and volatility. Time in the market beats market timing every time.

Does Time In the Market Beat Market Timing ?

Nobody can exactly predict a stock’s future price, but that doesn’t stop many from trying to do so. Study after study over the years has shown that “market timing” does not work and that “time in the market” is the way to go. That said, academia can be redundant. We’ve simplified the differences between time in the market and market timing to explain the best investing strategies for investors.

What Is Market Timing?

“Market timing” means buying a security with the expectation of selling it at a higher price in the short term. Market-timing investors are essentially trying to “beat the market” by outsmarting it—or so they think.

While market timing may initially seem to be a variant of the famous saying “buy low, sell high,” the fact that the future is uncertain and that stock prices change rapidly means that it is basically impossible to accurately and consistently determine when a security has hit its lowest or highest point.

What Does Time In The Market Mean?

“Time in the market” means relying on a strategy where you don’t try to guess when the market is at its lowest or highest point. Instead, you buy the market knowing that your timing will probably be off but that, eventually, the fundamentals matter more than the timing.

The “time in the market” investor will stick with the market until the original reasons for buying change or they’ve reached their intended goal, e.g., approaching retirement years.

Top 3 Reasons Time In the Market Is Better Than Market Timing

Stock prices are unpredictable. We do not know what is going to happen. And even if they were predictable, making money on investments would still be impossible as the market price wouldn’t budge from what everyone has calculated to be its future price. If a financial advisor tries to tell you otherwise, be wary.

When it comes to investments, company stock prices and markets fluctuate wildly on a daily basis. A market-timer may be tempted to sell their investment too quickly to capture a small profit or to avoid a loss despite the fact that their original theories as to why the stock may grow haven’t changed at all.

For instance, since 1950 the S&P 500 has seen calendar year returns vary from 47% up to 39% down. This is where the human psychology component comes into play. If you got “unlucky” in 2008 trying to time the market and you were down 39%, it is very difficult emotionally speaking to reverse course and try to time the market by buying. But if you use the time to your advantage, market volatility starts to wash out. Looking at the same 1950-2017 period, but looking through the lens of five-year investment horizons, returns for the S&P 500 ranged from down 3% to up 28%. Even in the worst five year period, you would only have been down 3%, which is much easier to stomach than down 39%.

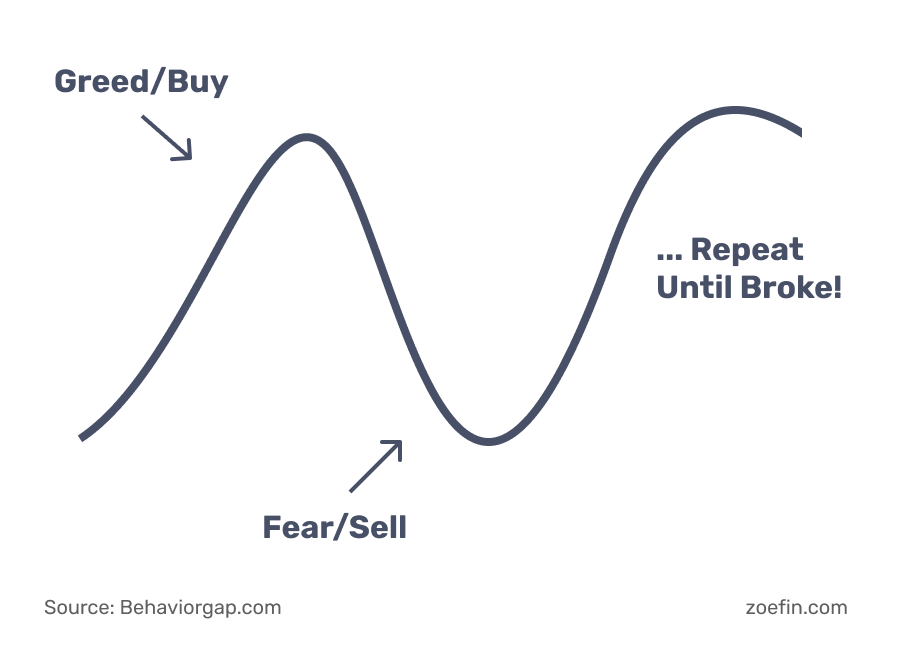

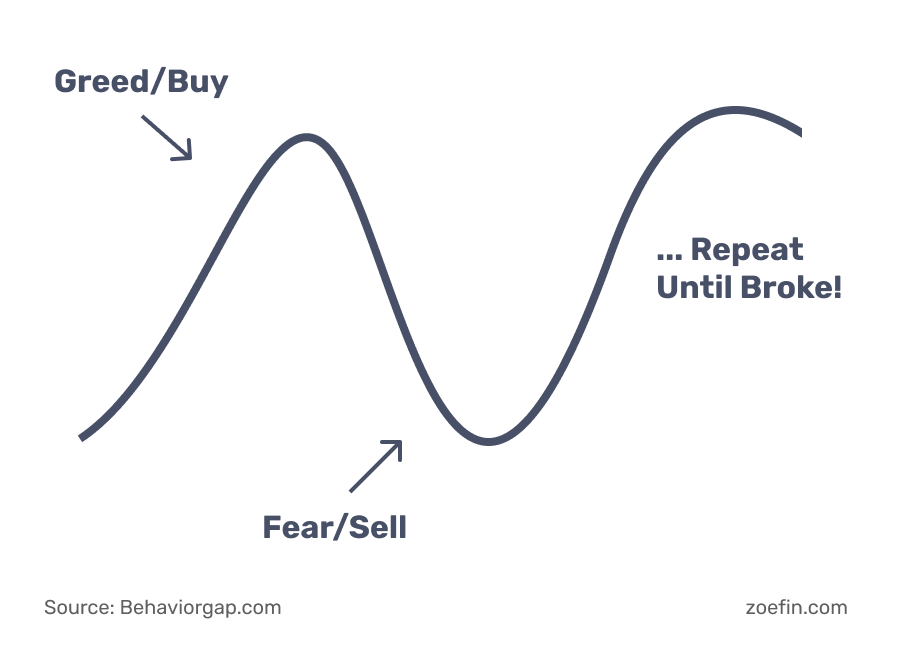

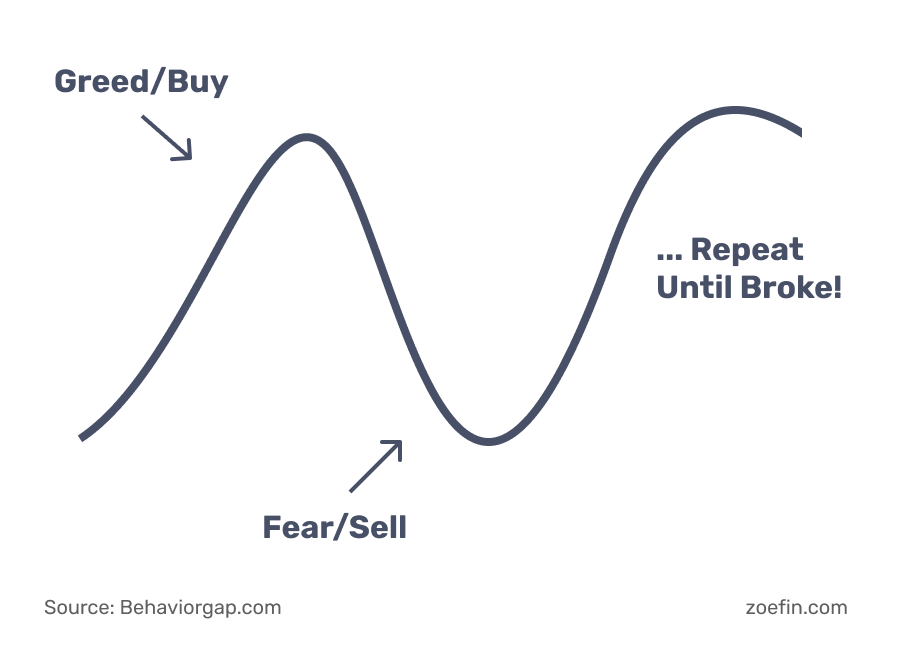

This is known as the “behavior gap”. Author Carl Richards states, “We’re wired to avoid pain and pursue pleasure and security. It feels right to sell when everyone around us is scared and buy when everyone feels great. It may feel right – but it’s not rational.”.

Market timing easily plays on our emotions in a way that overrides dispassionate and serious investment analysis. If there is a change in the fundamental reasons for you to believe in a stock, it is important to be willing to adjust your investments. However, market timing easily tempts us to jump out too early or stay in too long.

Frequent trading and trying to time the market will rack up brokerage commission costs, particularly for smaller investors. While the costs for a broker to execute a trade may be relatively low on a trade-by-trade basis, someone who trades frequently can see these fees & costs add up over time and significantly dent their investment returns.

Smart Investing: Focus On Your Longterm Financial Goals

It’s imperative to begin the investment process with a clear idea of your goals and the time frame for your financial plan to accomplish them. Once you do this, it should become clear that the goal is not to “beat the market” but to reach or exceed your personal goals. A diversified portfolio of investments held for several years has historically proven to provide greater returns than those who try to jump in and out of the market at what they believe are the lows and highs.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm – clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Zoe Financial does not provide legal advice.