What Active Investing Should Really Mean For Your Portfolio

Most investors consider “active” investing to be stock picking with the goal to outperform the broader market. However, an active investing framework can actually provide a rigorous, objective, and holistic approach to investing.

According to Gallup (2019), 61% of Americans invest in order to achieve their goals. Be it retirement, travel, starting a business, supporting others, or simply earning higher returns – the ultimate goal of investing is to make more money or preserve its value. Nevertheless, achieving that goal is where it gets a little tricky.

Active vs. Passive Investing

Active and passive investing are two distinct strategies, each with different goals and outcomes. It’s crucial to understand which approach aligns with your unique needs.

What Does Active Actually Mean?

Most investors consider “active” investing to be stock picking with the goal to outperform the broader market (i.e. S&P 500 Index). The investor (or the financial advisor on behalf of the investor) buys or sells individual stocks based on specific factors, hoping to pick more winners than losers.

In contrast, “passive” investing employs a buy-and-hold strategy aimed at generating long-term market returns by investing in benchmark indexes, accepting benchmark returns while reducing trading costs and improving tax efficiency.

Historically, there has been a lot of debate on the “active” vs. “passive” investing topic and whether there’s an actual value added to pursuing active investing.

The Evolution of Investing

Investment methods have evolved significantly over time. Before World War II, individual investors mostly owned individual stocks. In the 1950s, mutual funds gained traction, democratizing investing by lowering costs. The introduction of 401(k) plans in 1974 through the Employee Retirement Income Security Act (ERISA) marked a pivotal moment, further boosting mutual fund adoption during the bull markets of the 1980s and 1990s.

Exchange-Traded Funds (ETFs) were introduced in the 1990s, offering a more cost-effective and tax-efficient way to invest while trading like regular stocks. ETFs not only broadened access to domestic stocks but also provided exposure to international markets, commodities, and currencies that were previously hard for individual investors to access. According to a report from the Investment Company Institute, after the ‘08 Global Financial Crisis, ETFs gained further adoption and grew from $531B to approximately $5.45T from 2008 to 2020.

With the backdrop of commission-free stock trading, a new way of owning stocks has emerged: Direct Indexing. Direct Indexing allows for personalized and customized portfolios without having to “pool” different people’s money. In other words, it is the equivalent of building your own unique ETF.

This evolution has also transformed the role of financial advisors.

Understanding Wealth Creation Today

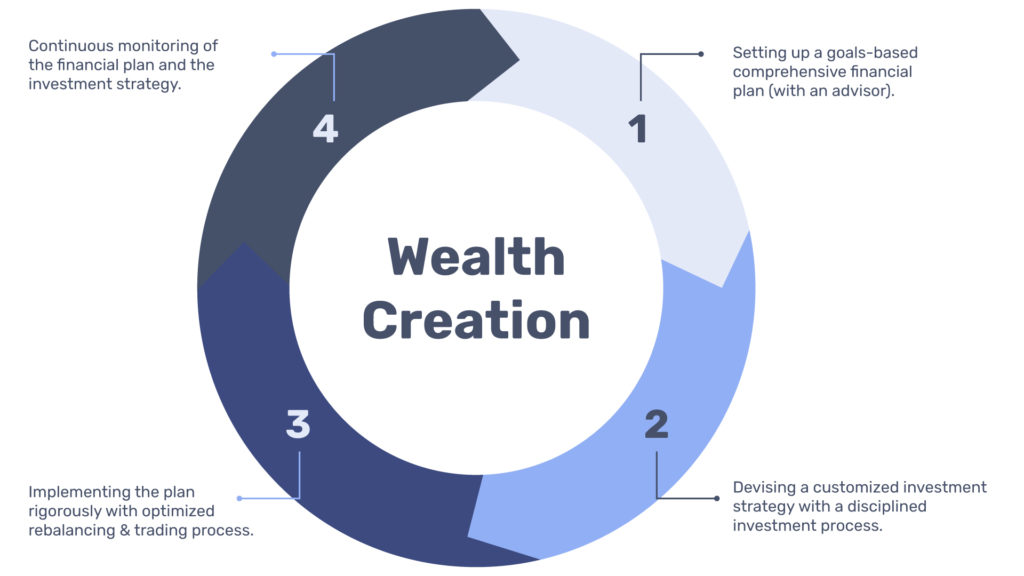

An active framework can offer a rigorous, objective, and holistic approach to investing.

There are several investment frameworks that can help you achieve your financial goals. The key is to have a framework and the discipline to stick to it.

So how are advisors working with an “active” framework? Most of the action will happen behind the scenes. Here is an example of the activities an advisor would do:

- Create a list of investable Asset Classes.

- Develop a Strategic Asset Allocation using historical and forward-looking expectations of the asset classes.

- Select appropriate Asset Allocation consistent with your preferences (risk, goals, time horizon).

- Choose the investment styles (passive/hybrid/active) along with the investment vehicles (some of the widely used ones are below):

- ETFs

- Mutual Funds

- Individual Stocks

- Follow a disciplined and tolerance-based approach to rebalance accounts & minimize drift between you and your target portfolio.

- Regularly monitor portfolios to ensure you stay on track to achieve your goals.

- Schedule regular check-ins with your advisor to assess any changes in your situation that may require adjustments to your goals and strategy.

6 Ways the “Active Framework” can Provide Value

Hint… it’s not about beating the market:

- A goal-based approach leads to higher client engagement and a greater likelihood of sticking to the plan in fluctuating markets.

- Selecting the right asset allocation could have a huge impact on overall progress for your goals… According to research,

- from Brinson, Hood, and Beebower (1986), 90%+ of portfolio returns could be attributed to asset allocation.

- The disciplined process of choosing/developing the investment strategy helps maximize the risk-reward potential while minimizing the overall costs.

- Regular portfolio rebalancing helps minimize portfolio drift (the difference between the current and target portfolio) while keeping emotions out of the day-to-day portfolio management.

- Advisors should keep you motivated and accountable for staying on track, especially during market swings.

- In short, life is fluid and ever-changing… And your financial plan should be too!

The Bottom Line

Active investing is not a get-rich-quick scheme. Although most people may think of it as a stock-picking strategy that outperforms the market, we believe in using it as a framework rather than an investment management style.

Selecting the right asset allocation can have a huge impact on the progress of your financial goals, and this is one of the many ways an active framework can provide value to your investment strategy.

Building wealth while navigating through the challenges in life is a marathon and not a sprint. By establishing a consistent process to follow, you can work toward potentially achieving better outcomes over time.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm – clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Zoe Financial does not provide legal advice.

“>