Standardizing Operations & Automation to Drive Efficiency

This rapidly growing RIA, which has expanded significantly through organic and paid means, needed a platform to enhance operational efficiency and manage its growth. Their previous TAMP fell short of delivering the promised level of service, leaving them needing better support.

By adopting the Zoe Wealth Platform, this firm successfully standardized its operations, reduced costs, and automated labor-intensive tasks, leading to more effective scaling.

Client Profile

Enterprise RIA seeking to enhance operational efficiency.

$10M

in AUM

Organic & Paid

channels to drive growth

Firm's Pain Points

Managing Small Accounts

The firm struggles with managing and servicing clients with less than $500K, representing 50% of its total accounts but only contributing 18% of its revenue.

Transitioning Acquired Books

When acquiring a firm that uses a different custodian, the operational team must manually set up accounts and transfer funds for each new client. This process requires significant time and resources that could be allocated to more strategic business areas.

Cost of Servicing Small Accounts

The firm invests the same level of resources and incurs similar expenses to service these smaller accounts as they do for larger, more profitable ones, leading to inefficiencies and higher operational costs.

Zoe's Solution

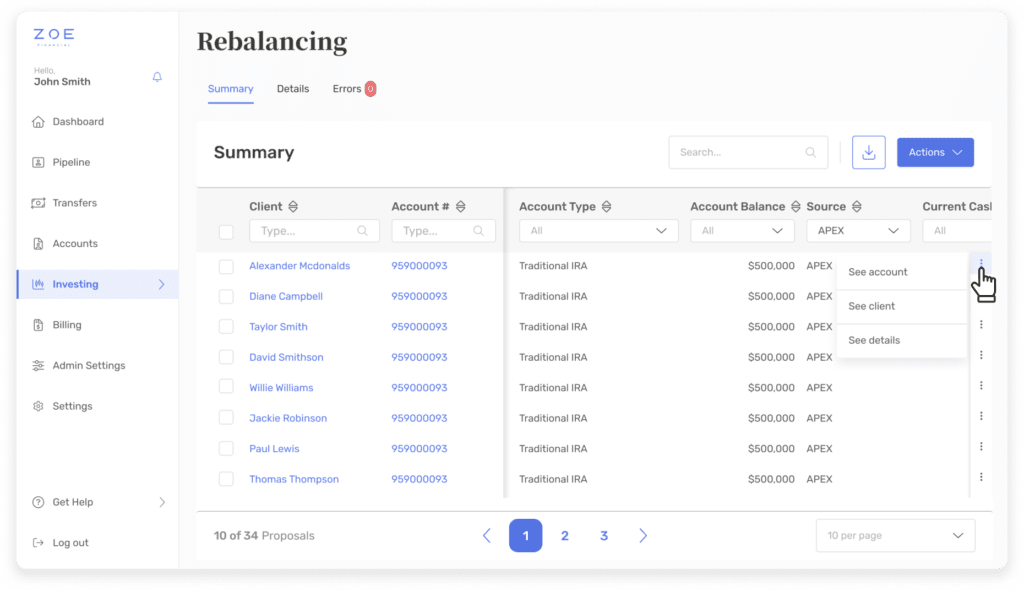

Automated Trading and Outsourced Operations

The firm leverages our rebalancing tool and operations team to manage smaller accounts efficiently, ensuring these clients receive high-quality service without draining internal resources on this low-revenue segment of their portfolio.

Repapering Accounts

Our Client Success Team works with the acquired advisor(s) to aggregate all their clients, initiate ACAT transfers, and onboard all transitioning assets to the Zoe Wealth Platform. Allowing the firm’s operation/client servicing teams to focus on more strategic tasks.

Cost-Savings

Our platform’s all-inclusive fee structure enables this enterprise firm to reduce costs by migrating smaller accounts to the Zoe Wealth Platform.

The Outcome

By leveraging Zoe, the enterprise RIA successfully outsourced and automated two key segments of their business, reducing operational costs by 27% and freeing up valuable time for their operations team.

The information in the visuals is for informational purposes only, and does not represent an actual user’s account, balance, or return and does not represent target or projected performance of any user’s account.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm – clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. Zoe Financial does not provide legal advice.