What is Equity Compensation?

Published: April 24th, 2025

Reading Time: 7 minutes

Written by: Keith Corbett, CFP®

Equity compensation is a type of non-cash benefit that some employers offer employees as part of their total compensation package. Instead of receiving only a salary and bonuses, employees are granted potential ownership in the company through stock options, restricted stock units (RSUs), or other equity-based incentives. This form of compensation can be highly valuable, but it also comes with complexities related to taxation, financial planning, and company growth potential.

How Equity Compensation Works

At its core, equity compensation aligns employees’ financial success with the success of their company. Employers may offer equity through:

- Stock Options: The right to purchase company stock at a predetermined price (often lower than market value). This includes Incentive Stock Options (ISOs) and Non-Qualified Stock Options (NQSOs), which can have different tax treatments.

- Restricted Stock Units (RSUs): Shares awarded to employees that vest over time, meaning the employee must stay with the company for a set period before gaining full ownership.

- Employee Stock Purchase Plans (ESPPs): Programs that allow employees to buy company stock at a discount, with potential for favorable tax treatment.

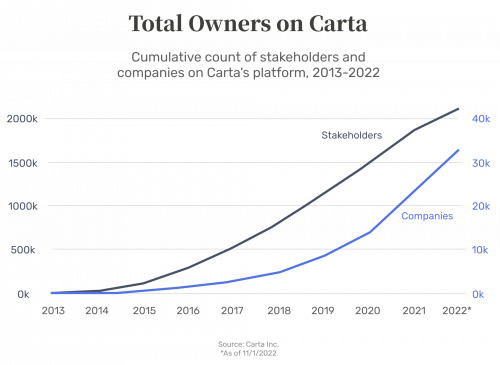

The Growing Popularity of Equity Compensation

Equity compensation has become increasingly common in both public and private companies. A decade ago, only about 10–20% of Fortune 500 companies widely offered equity compensation. Today, approximately 50–75% of these companies include it in their employee benefits package, particularly in competitive industries like technology and biotech. According to a 2024 Morgan Stanley study, 76% of HR leaders reported offering some form of equity compensation, marking a steady increase in its adoption.

Companies use equity compensation as a tool for:

- Attracting talent: Particularly in startups or high-growth industries where cash salaries may be lower.

- Retaining employees: Many equity grants come with vesting schedules, requiring employees to stay with the company for a set number of years before they fully own their shares.

- Aligning employee and company success: Employees benefit when the company grows, creating an incentive to contribute to long-term success.

Tax Implications: Why Proactive Planning Matters

Taxes play a crucial role in equity compensation and can create unexpected financial burdens if not properly planned. Each type of equity has different tax consequences:

- Stock options: When exercised, NQSOs are taxed as ordinary income, while ISOs may qualify for lower capital gains tax rates if held long enough. (Exercising ISOs can also trigger AMT tax!).

- RSUs: Taxed as ordinary income when they vest, meaning employees must plan ahead to cover potential tax liabilities.

- ESPPs: Tax treatment depends on how long the stock is held after purchase, with potential advantages for long-term holders.

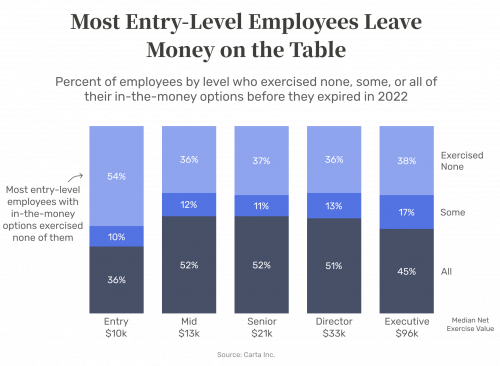

Tax liability can be intimidating and tends to be the main reason employees leave money on the table by not exercising in-the-money options. It can also make for a nasty surprise, specifically when exercising ISOs (employers don’t withhold taxes), if the money has already been spent on something like a down payment. Proactive planning with a financial advisor can help employees make informed decisions and minimize tax liability.

Pre-IPO vs. Post-IPO Equity Compensation

One of the biggest factors in managing equity compensation is whether the company is private (pre-IPO) or public (post-IPO). Each stage presents unique opportunities and risks that require careful planning.

- Pre-IPO Companies: Employees may hold stock that isn’t liquid, meaning they can’t sell it immediately. Planning for a future liquidity event (such as an IPO or company sale) is critical to ensuring they’re prepared for both the financial windfall and the tax implications that come with it.

- Post-IPO Companies: Once a company is publicly traded, employees can sell their shares, but they must navigate stock price volatility, tax consequences, and diversification strategies to avoid over-concentration in a single stock.

Understanding how to manage equity at each stage can significantly impact long-term financial outcomes.

Why a Proactive Approach Is Essential

Equity compensation can be a valuable wealth-building tool, but without careful planning, employees may face unexpected tax bills or missed financial opportunities. In fact, a 2022 study by Carta (see image above) found that over 50% of entry-level employees didn’t exercise their in-the-money stock options before they expired — essentially walking away from compensation they had earned. The median value of those unexercised options was $10,000 at the entry-level and $96,000 at the executive level. Put simply, it’s like turning down a bonus from your employer without even realizing it. To avoid a major financial blunder and make the most of their equity, employees should:

- Understand their grants: Know the vesting schedule, tax implications, and expiration dates.

- Plan for taxes: Work with a financial professional to strategize when and how to exercise or sell stock.

- Align equity with financial goals: Consider how stock compensation fits into long-term objectives like home purchases, college savings, or retirement.

By taking a proactive approach, employees can maximize the benefits of their equity compensation while avoiding costly mistakes. Working with an advisor who specializes in equity compensation can help ensure they make informed, strategic financial decisions.

Disclosure: This page is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. The observations of industry trends should not be read as recommendations for stocks or sectors.

Bluebird Wealth Management Disclosure: This presentation is not an offer or a solicitation to buy or sell securities. The information contained in this presentation has been compiled from third-party sources and is believed to be reliable; however, its accuracy is not guaranteed and should not be relied upon in any way whatsoever. This presentation may not be construed as investment, tax or legal advice and does not give investment recommendations. Any opinion included in this report constitutes our judgment as of the date of this report and is subject to change without notice.

Additional information, including management fees and expenses, is provided on our Form ADV Part 2 available upon request or at the SEC’s Investment Adviser Public Disclosure website, www.adviserinfo.sec.gov. Past performance is not a guarantee of future results.