What do you want to accomplish? Let’s get you there. If you’re just joining us in the series, we suggest you take the time to read the previous two pieces (here and here) that enable you to both determine and evaluate your personal and financial values set. Once you have established what your values are, it’s important to create actionable goals. Financial planning at its simplest is the creation of financial goals, the constant assessment of your progress and the regular adjustment of these goals to suit your ever-changing lifestyle. We’ve done a lot of the heavy lifting in parts 1 and 2 – now, the setting of achievable goals becomes a simpler 2-step process.

Step 1: Don’t set too many goals at once

If you put 100 things on Monday’s to-do list, it’s not all going to get done. Similarly, if you have 20 short-term goals you’re working to accomplish, you’ll likely become overwhelmed just looking at your list and burnout will be inevitable long before achievement. Research completed in a series of three studies and published in the Journal of Consumer Research, demonstrated not only that participants needed to believe their goals were within reach, but also that if participants perceived there were too many tasks to accomplish, working on one created a feeling that the other tasks were being neglected instead of a positive feeling of progress. It sounds a bit counter-intuitive, but fewer goals correlate to a greater likelihood of accomplishment.

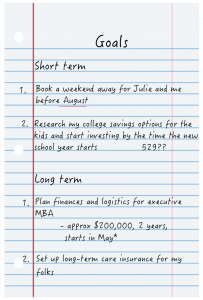

Start with 2-4 short-term realistic goals, and for the sake of keeping the big picture in mind, add one or two long-term goals for each increment of 5 years from now. As you accomplish goals, set new ones.

Step 2: Write your goals down

Simply having goals isn’t enough; everyone has goals and many people aren’t accomplishing them. Fascinating research by Dr. Gail Matthews of Dominican University demonstrates that there is a positive effect when it comes to writing down goals and successfully attaining them. Dr. Matthews recruited 267 people from a variety of ethnicities and professions and discovered that the average level of goal achievement was significantly higher in participants who wrote down their goals compared to their peers who merely thought about them. In the study, participants typed their goals into an online survey, but bonus points if you go the pen and paper route: Wall Street Journal, The New York Times, and Psychology Today have all published articles referencing research that physical handwriting, instead of texting or typing, has numerous neurological benefits.

“Matthews found that more than 70 percent of the participants who sent weekly updates to a friend reported successful goal achievement (completely accomplished their goal or were more than halfway there), compared to 35 percent of those who kept their goals to themselves, without writing them down.” (Dominican University of California)

There’s no end to the advice on the great expanse of the internet that promises to help you achieve your dreams, but if we spent less time googling “how to accomplish my goals” and simply started our journey we’d all be better off!

By this stage, you have hopefully been able to verbalize and prioritize your personal values and align these with your financial priorities. We hope you now understand the importance of translating these financial priorities into clear and specific financial goals.

In our 4th blog in this series, Stay The Course, which will be here next week, we develop the idea of goals setting even further and discuss the concept of continuity – keeping yourself on track to achieve these defined goals as time passes and life happens. Stay tuned!

To start at the beginning of this Wealth Is Personal blog series, click here.

*https://executivemba.wharton.upenn.edu/emba-academic-calendar/