Dating and Digital Acquisition: What Stage Are We In?

Reading Time: 4 minutes

Digital dating allows you to find “the one,” be it a soulmate or a financial advisor. Could it be around the corner for wealth management?

Q: “Where did she find him?”

A: Whispering: “The internet! Can you believe it?”

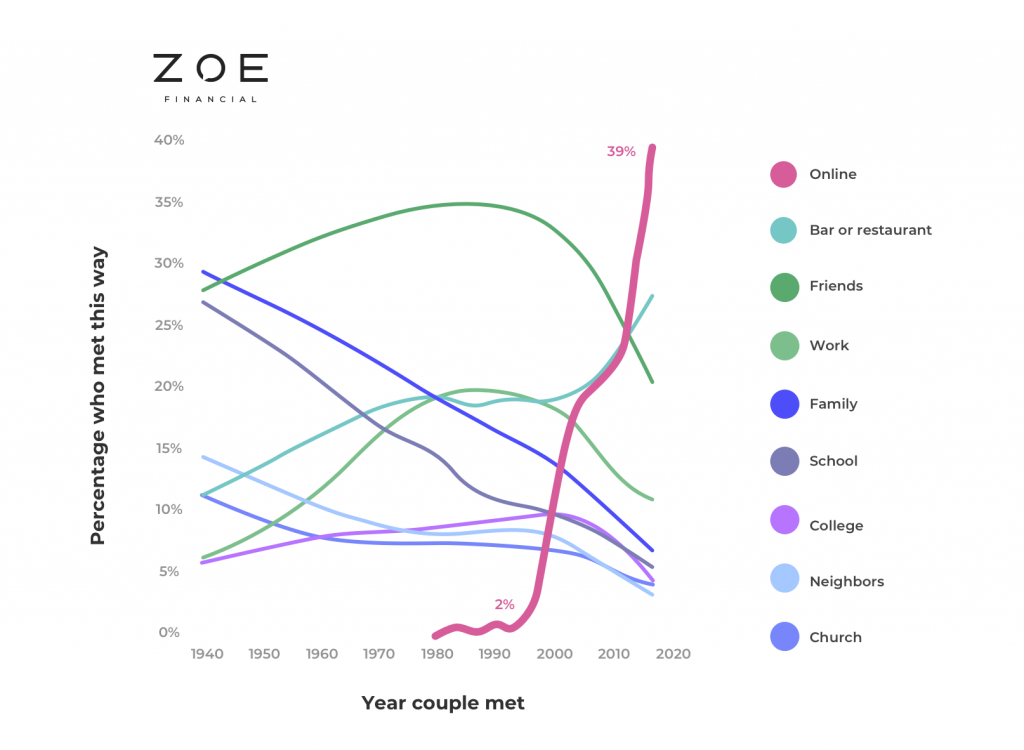

Back in 1997, two of my cousins were having their annual Holiday gossip session. The hot topic of discussion? How my recently married second cousin had found her husband on something called the internet. Their digital match was discussed in hushed tones and not at all mentioned over dinner, where the topic was considered taboo. The internet was not a place where long term relationships were forged. This is not surprising, considering that during that year only 4% of people found their partner online.

The digital world has allowed us to shift from taboo to typical. It is now commonplace to access a digital marketplace to purchase everything from soap to your iPhone, and there’s data to prove it!

The Digital Marketplace

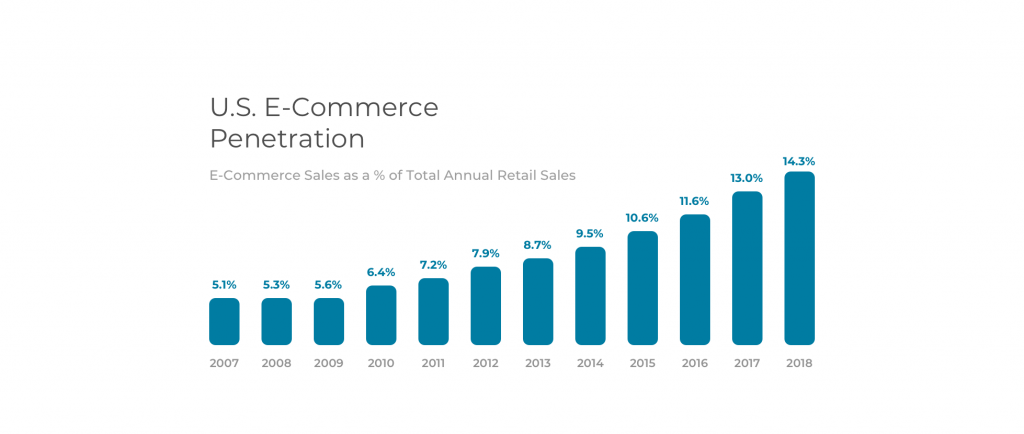

As the chart below shows, in only a decade, the web has almost tripled its share of retail sales from 5% to ~14.3%. That represents about ~$500bln worth of retail goods that are now bought online yearly. To put it in perspective, we’re talking about nearly the same amount as Sweden’s annual GDP. Furthermore, be it the 13.6 million Amazon Prime items delivered a day or the empty storefronts littering suburban landscapes across the United States, it’s clear the digital marketplace is here to stay.

You’ve likely experienced this trend in your day-to-day and aren’t at all surprised by the prevalence of e-commerce penetration. Yet, the service economy lags behind the “product” economy in the digital world as many question the ability for services to “scale” the same way that products have. After all, in the service industry, the “product” is often a human doing a task. This can make the quality in services more subjective. In addition, some service industries are highly fragmented which delayed the process of coming online. As a result, we have yet to witness this exponential growth occur when it comes to online consumer services. Currently, while the service economy accounts for 69% of national consumer spending, only 7% of services are primarily done digitally.

Offline to Online: Dating

The proliferation of digital services can be seen most acutely in the dating world. Rapidly, specialized courtship websites led to the creation of countless apps designed for meeting and dating new people.

Fast forward to 2017, and as Stanford University reported, a whopping 39% of people now find their significant other via the web. As seen below, the internet went from a non-category 20 years ago to THE medium for people to pair up today.

The dating industry is a $2.5 billion dollar industry, while the North America Wealth Management industry is a $400 billion industry. Thus, there is an evident opportunity within the finance world to use the digital medium to provide specialized services. We have yet to see as rapid digital impact in wealth management; however, we can attribute this to the age of early adopters. Online dating users early-on tended to be in their 20’s and 30’s. Therefore, it’s only reasonable that they would be the first to jump on digital services. We know that dating services aren’t quite as complex or heavily regulated as wealth management. Yet, plenty is being done to close the digital divide in finance consumer services.

Offline to Online: Wealth Management

The age of technology users matures daily. A 50-year-old has been using Google and their iPhone since their early 40’s. They’ve been on the internet since their late 20’s! Because of this, most of their professional lives have been experienced through the digital era, with constantly advancing tools and services that create seamless experiences on and off-line. Therefore, it’s no surprise that at Zoe Financial, we witness thousands of people searching to find their financial advisors via the internet.

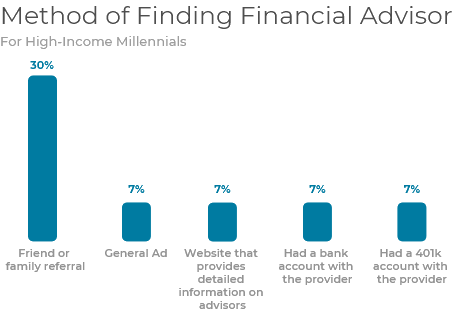

A great example is the Millennial population. As reported by Spectrem Group, 49% of high income millennials have a financial advisor. Understandably, some folks may still feel uneasy about trusting their finances to an advisor they found via the digital space, much like maybe 10 years ago they felt uneasy finding their next date via an app…but the times, they are changing.

The "One"

It’s no longer taboo to find “the One” on the internet, be that your soulmate or your perfect financial advisor. As a number of studies show, the future of complex consumer services in the digital arena is hardly far-off. If a digital finance marketplace is able to consistently provide the highest quality of service for the consumer and frictionless user experience for advisors, then the exponential growth exhibited in the digital dating world could be right around the corner for wealth management.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners