The Value of Starting Early: Hiring a Financial Advisor for Millennials

Reading Time: 6 minutes

As a millennial, hiring a financial advisor is a unique but incredibly valuable experience.

Millennials don’t have the best reputation when it comes to their financial habits. Countless articles, financial journalists, and studies critique alleged over-spending and even poke holes at the desire for a daily cup of coffee. Bank of America research shows one in four millennials worry often about their finances. They have unprecedented and unique financial struggles. For many millennials, the top stressor is often not having enough saved. Yet a financial advisor for millennials can provide infinite support in creating a plan.

How To: Hiring a Financial Advisor as a Millennial

The picture isn’t as bad as it looks. The same research also shows 63 percent of millennials are saving and 67 percent who have a savings goal meet it. It is possible, with the right help. Organizing your finances shouldn’t become part of the long to-do list that tends to result in what Buzzfeed calls ‘errand paralysis’. Just because it doesn’t require immediate attention, doesn’t mean you shouldn’t start now.

Why Are Millennials Struggling Financially?

Millennials are facing many challenges when it comes to getting their finances in order. High costs of living, staggering college debt, the fallout of the Great Recession and the most uncertain job market in recent decades are some of them. A large portion of a millennial’s budget is most likely allocated to high rents and paying off debt. That means there is little to spend freely or save.

Millennials are financially worse off because their net worth is less than prior cohorts. A recent Deloitte study shows the net worth of Americans ages 18 to 35 has decreased by around a third (34%) since 1996. They are also predominantly stressed out about debt, according to a recent Insider and Morning Consult survey for ‘The State of Our Money‘ series. By default, millennials are pushing back major life events because they can’t afford them. Incomes haven’t increased as fast as rent, home prices, and college tuition. The annual salary of a millennial today is about 20 percent lower than that for a baby boomer at the same age. The same Deloitte study also shows that they spend about 17 percent of their incomes on education, health care, and rent. This, compared with 12 percent a decade ago.

According to the Pew Research Center, 29 percent of millennials who aren’t married say the reason they’ve put off marriage is financial instability. Similarly, stagnant wages have resulted in millennials renting longer and delaying homeownership. Perhaps more worrying, 55 percent say they don’t have a retirement savings account. This is because they can’t afford to contribute to one.

What Is Important To Millennials When It Comes To Financial Advice?

Despite common thinking, millennials are more disciplined when it comes to money. They are more dedicated to saving and nearly 3 in 4 stick to their budgets. They are also more risk-aware and practical, having lived through two or, some, three financial crises. They want risk-aware and practical financial advice that suits their lifestyles. This is crucial when hiring a financial advisor for millennials.

Millennials have a different definition of financial success. According to a Merrill Lynch Wealth Management report, only 19 percent define it as being rich. An overwhelming 60 percent define it as being debt-free. And it makes sense. With debt being the predominant financial stressor amongst them. But they also live life with a ‘treat yourself’ mentality.

Two-thirds of millennials said saving for the future is as gratifying as treating themselves today. As such, they are not looking for advice that reinforces the idea of them being irresponsible. They want advice that is non-judgmental and tailored to their circumstances and lifestyle. Not one that judges their monthly treats but gets them a rich bank account.

What Do Millennials Look For In a Financial Advisor?

Millennials look for an advisor with the right background, education, and training. This usually looks like having the right credentials, like being a Certified Financial Planner (CFP). It means you can be sure they’ve completed the accreditation process with the required experience. But they also look for someone who treats them as an equal.

This means an advisor who most likely has worked with similar clients – other millennials – before them. Someone who is familiar with their struggles. Someone with whom they can build good rapport. They will be talking with them regularly and sharing a lot, so they don’t want to be uncomfortable, or feel as thoughthey are being judged.

Millennials also look for someone who has a succession plan, in case something prevents the advisor from working with them. The advisor should also be someone with a good network of multidisciplinary professionals. This way, the advice given is practical and it all comes from one place.

Millennials care about their investment philosophy, tech stack, and fees. They want someone who has experience with social impact investing and digital tools. All in all, they are looking for a financial advisor that offers one-stop tailored service. Someone who caters to their life right now but also plans for the future, even if they don’t plan to retire anytime soon.

Do I Need a Financial Advisor in My 30s?

Yes. Now is the ideal time to find an advisor who considers both your short- and long-term financial goals. Even if you are now looking to buy your first home, saving for retirement should still be on your horizon. The right financial advisor will incorporate both in a strategy that works for your circumstances without too much sacrifice.

A financial advisor will make sure your money is working for you no matter what your plans may be. They will guide you through the power of compounding interest and the importance of starting early. Because you have to be in the game to have a chance of winning. Missing the top 10 days in the market over a 20-year period can cut your returns by half, research shows.

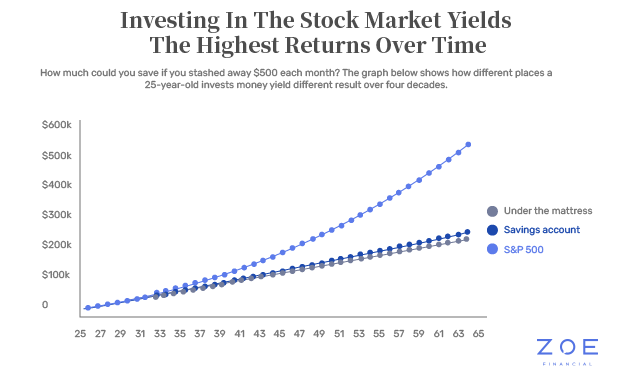

Say you invest $100 every month in the stock market for the next 30 years. This would give you $117,000 with a 7% return in your 60s when you are nearing retirement age. If you do it for 40 years – so either start earlier or until your 70s – it would be more than $248,000. Over the years, this is a significantly larger return than if you had just left the money in a savings account, as you can see in the graph.

Hiring a financial advisor is a natural next-step as your financial goals change. Financial growth is exciting and can take you to the next level financially. This also means you can continue treating yourself with the ease of mind of knowing you are actively building a safety net for yourself in case you need it.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners