Values & Faith-Based Investing

Written by:

George Newfield, CFA, CFP®, CKA®, CAIA

Zoe Network Advisor

Values & Faith-Based Investing

Written by:

George Newfield, CFA, CFP®, CKA®, CAIA

Zoe Network Advisor

Child labor, climate change, tobacco, access to education, and renewable energy are all issues at the center of values-based investing.

Child labor, climate change, tobacco, access to education, medical research, and renewable energy… These are all issues at the center of values-based investing. The rise of values-based investing has led to some of the most significant changes in decades in the investment industry.

Mixing & Matching Is Not Limited to Clothing Options

What is values-based investing? It is investing for returns (income and gains) while making a difference in the world. ‘How’ you make this difference depends on what your values are. The Cambridge Dictionary defines values as “the principles that help you to decide what is right and wrong, and how to act in various situations.” We must recognize the subjectivity of this definition. Values are shaped by personal experiences, beliefs, and traditions, making them vary from one individual to the next. There are as many ways to reflect our values in investing as there are ways to wear clothing.

Some people prefer certain brands of clothing to the exclusion of others, while others are more interested in the impact clothing has on their appearances. Others simply look for whatever fits their style. Values-based investing works similarly, given the wide range of options. However, one rule transcends beliefs, cultures, and time. Many of us know it as ‘The Golden Rule’: we are to treat others as we would like to be treated. What if we could invest to earn returns while also promoting the values we believe will help the world and all those in it to flourish?

Investing and The Golden Rule

At first, all this talk about doing good in the world may appear out of place in the context of investing. Indeed, a philanthropic-minded person can make an impact by giving of their time, talents, and treasures. So, what is the difference between values-based investing and philanthropy?

A critical difference between values-based investing and philanthropy is the component of productive capital. Productive capital can produce returns while simultaneously making an impact. Companies can make a profit by building and selling products that impact people’s health or funding research to save lives and alleviate suffering. Where you invest is selected by choice and it’s not limited to stocks. According to The Forum for Sustainable and Responsible Investing, “Sustainable investing spans a wide range of products and asset classes, embracing not only public equity investments (stocks), but also cash, fixed income (bonds), and alternative investments, such as private equity, venture capital and real estate. Sustainable investors are like other investors in seeking a competitive financial return on their investments.”

With values-based investing, many investors consider what businesses their retirement savings support and how those businesses align with their values. The most prevalent form of values-based investing is known as ESG.

The Styles and Colors of Values-Based Investing

ESG Investing

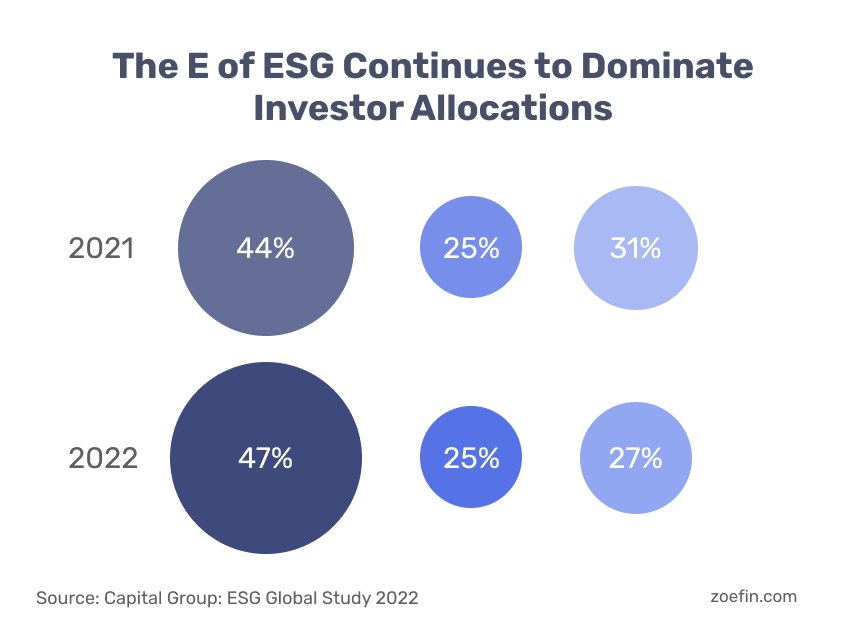

The acronym ESG was first coined in the early 2000s and stands for Environment, Social, Governance. The environmental component of values-based investing focuses on investing in companies that are mindful of their environmental impact by reducing carbon emissions, water stress, pollution, and focusing on clean energy. According to an ESG Global Study 2022 by the Capital Group, “E” Environment is the most significant part of ESG, meaning more money is allocated to this factor than the other two. The “S” looks at companies’ efforts to protect people and communities, paying attention to human and labor rights, product safety, access to capital, etc. Governance, or “G,” refers to board diversity, executive pay, business ethics, and anti-competitive practices, among other variables. This style of values-based investing looks at many aspects of a company and assigns “ESG Scores” based on how companies rank on the various facets of E, S, and G, respectively.

Sustainable Investing

Sustainable Investing is a form of values-based investing. Though sometimes the terms are used interchangeably, sustainable investing generally entails more active involvement by investors.

According to the Forum for Sustainable and Responsible Investing, “Just as there is no single approach to sustainable investing, there is no single term to describe it. Depending on their emphasis, investors use labels such as: “community investing,” “ethical investing,” “green investing,” “impact investing,” “mission-related investing,” “responsible investing,” “socially responsible investing,” and “values-based investing,” among others.”

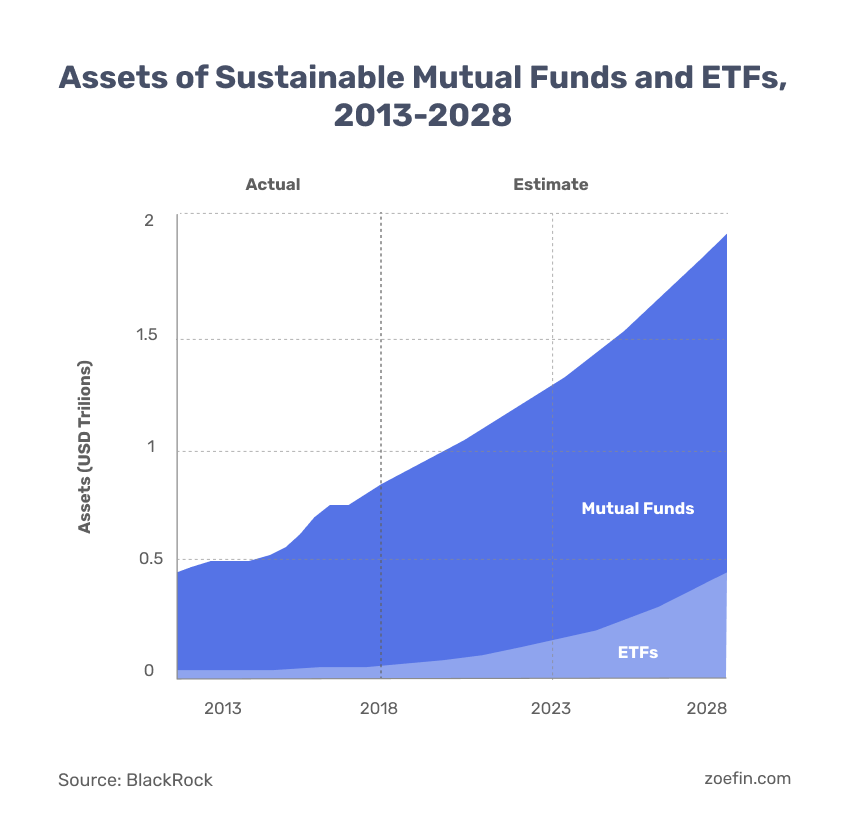

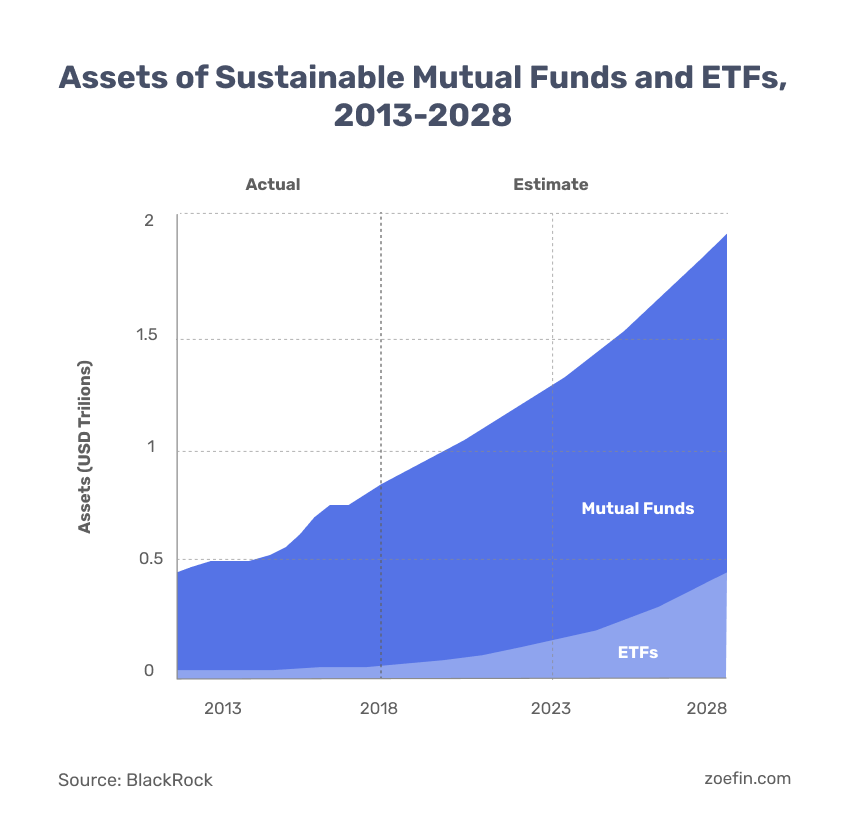

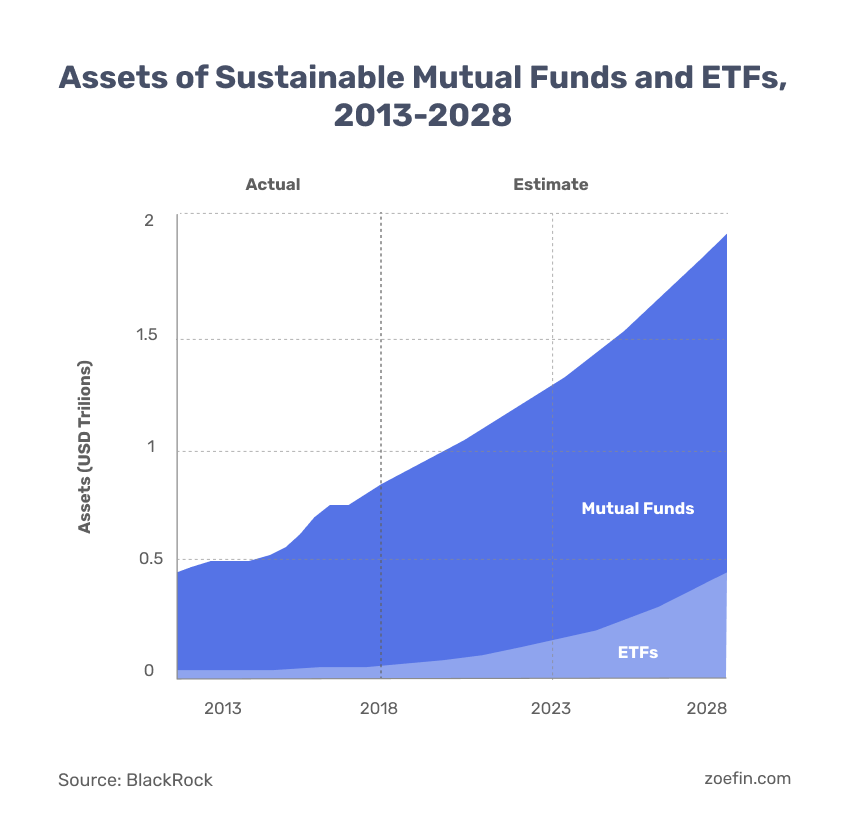

Sustainable investing often involves investors advocating for specific values-based outcomes. This could mean having influence with boards and company leadership advocating for better ways to allocate productive capital. It could also mean investing in a specific project with measurable ESG goals. This catch-all category has grown tremendously in recent years and is posed to see continued growth in future years. The graph below shows the current and expected proliferation of Sustainable Investing.

Socially Responsible Investing

Another values-based investing mix is “SRI,” or Socially Responsible Investing. SRI is less concerned with a score and more concerned with avoiding certain companies that may be involved in ethically challenging practices or products. Examples include tobacco, alcohol, firearms, and environmental damage. SRI investors will exclude entire industries, while ESG may invest in companies that are the “best house in a bad neighborhood.”

Impact Investing

Impact Investing takes an even more positive approach to investment. Instead of excluding bad actors, impact investors target companies and projects that will yield the greatest good for people, communities, and the environment. According to the Global Impact Investing Network, “The growing impact investment market provides capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation, microfinance, and affordable and accessible basic services including housing, healthcare, and education.” By considering the big picture, impact investing prioritizes the issues that will facilitate the most significant positive impact.

Faith-Based Investing

Faith-based Investing is a timeless form of values-based investing. The most prominent value sets represented in faith-based investing are Catholic, Protestant, Jewish, and Sharia. Faith-based investing can adopt various values-based investing styles.

For one, it can take the form of SRI screens to avoid investing in companies involved with such things as tobacco, pornography, and child labor. Faith-based investing can also take the form of impact investing, such as providing housing for vulnerable communities. Finally, advocacy with corporate boards is another way that faith-based investors can express their values and impact corporate actions.

Performance of Values-Based Investing

There is evidence that businesses which consider the interests of stakeholders (clients, employees, communities) along with the interests of their shareholders, and whose business activities are directed at making a positive impact in the world, are also more likely to prosper. This topic has been well studied, and an NYU Stern study from 2021 that looked at over 1000 research papers examining ESG and financial performance showed that out of the 1000+ research papers, 58% of the studies demonstrated a positive relationship between ESG and financial performance, and only 8% showed a negative relationship. Also, according to The Forum for Sustainable and Responsible Investing, “A growing body of research demonstrates that sustainable investment funds on average over the long-term achieve comparable or even

better financial returns than conventional investments.”

How to Begin Values-Based Investing

Although values-based investing is not new to the investment industry, it may be new for you. As with anything new, the fear of the unknown or analysis paralysis can keep you from acting. If this happens, remember the golden rule, and don’t be afraid to try something new! If you don’t know where to start constructing a portfolio that aligns with your values, finding the right advice can help. Talk to a financial advisor that can support your decisions and start aligning your investments and your values.

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners