Nowadays we live in a fast changing and very volatile market. Retirement planning in a bumpy market can be difficult and stressful! Think of it as riding a rollercoaster: While the thrill we feel from a roller coaster never changes, it seems the older we get, the more cautious we become. Is this high, hilly and loopy structure made of metal and wood safe? When was the last time the ride was inspected and tested for safety? Have there been any accidents or injuries related to riding this roller coaster?

Roller Coasters Safety

The International Association of Amusement Parks and Attractions (IAAPA) has substantial research to calm those fears, in fact, roller coaster deaths are extremely rare. The 2017 Ride Safety Report surveyed U.S. and Canadian amusement facilities in fixed sites, and found less than 1 injury per million rides in 2017. Following posted instructions, like keeping hands and feet inside the ride, avoiding restricted areas, and good old common sense can help ease the nerves; unfortunately, the circumstances beyond our control might still make a ride unsafe.

The Financial Markets Roller Coaster …

If you’ve been following the financial markets over the past few weeks, you might have that same queasy roller coaster feeling. The market’s recent up-and-down-swings and news out of Washington, China and Europe have caused lots of looming recession speculation. Uncertainty in the market often causes individuals to make drastic moves with their investment portfolios, with potentially devastating consequences—especially if close to or in retirement.

Controlling What You Can

When it comes to managing your retirement portfolio in uncertain times, the best advice is to control what you can control. There are so many aspects of retirement planning over which individuals have no control, like changes in the inflation rate, tax rate changes, the future of Social Security and-you guessed it- market performance. However, there are several ways individuals can manage their retirement plan, even in an uncertain market.

Think about those aspects that you can control:

- How much you save,

- How spending may change,

- Staying invested—to help you focus on the right way to manage your portfolio.

Savings is Up, but Not High Enough

Although the US personal saving rate, at a little over 8%, is the highest it’s been since 2013, consider that the saving rate was above 10% prior to the mid-‘80’s. One reason for this is that many people ‘save’ by investing excess cash in stocks and bonds and stocking away income in 401(k) plans rather than in low-yielding savings accounts. Consider also that during times of expansion, individuals may feel more comfortable spending more or taking on more debt, which could lead to difficult consequences if the economy shifts unexpectedly.

Rule of Thumb= 15%

Many financial companies have studied the appropriate savings rate and have determined that to be on track for retirement, an individual should save about 15% of their pre-tax income a year. Although that savings rate is predicated on starting to save at a young age. Those who don’t begin saving until later may have to save an even higher percentage. So while the American consumer may be saving at a higher rate than in recent years, it is still not high enough to ensure an equivalent lifestyle in retirement.

One way to continue to maximize savings is by saving pre-tax income in your company’s 401(k). Many employers will match employee contributions, usually up to 5-6%, so it’s wise to maximize the match. But saving is half the battle; make sure that you’re investing your savings in a target date fund, or managed account if you are age 50+. These accounts may provide the diversification you need according to your current age and projected retirement age, and make risk-adjusted changes over time. If you are age 50 and over, make sure to take advantage of catch-up savings in your IRA and employer plans.

Retirement Confidence < Calculating Retirement

Retirement confidence is good, but calculating retirement is great. While 2/3 of workers report that they are saving for retirement and feel confident in their retirement preparedness, only about 4 in 10 have actually calculated how much they will need for retirement (2019 EBRI Retirement Confidence Survey). Determining how much is actually needed to live comfortably in retirement is key to understanding if you are saving enough- as well as how to anticipate future spending, and figuring out the appropriate replacement rate for retirement.

The rule of thumb for the approximate percentage of your pre-retirement income will be needed to sustain your lifestyle in retirement—AKA your “replacement rate”—is 80%. In other words, considering your current lifestyle and expectations, you will probably spend about 80% of what you’re already spending in retirement. Recent studies have challenged the 80% rule and have determined that for some individuals, the replacement rate may be as low as 70% or lower. That’s because certain expenditures drop off at retirement; payroll taxes may disappear, income tax rates may go down, certain spending on transportation, apparel, insurance and other spending may also go down.

The Retirement Spending Smile

On the other hand, some expenses like health care and long term care may increase—perhaps not immediately but they will likely surpass other spending as your retirement years continue. Overall, this pattern of spending in retirement could result in what some experts call “the spending smile.” This visual illustrates how spending early in retirement could begin at a high level—as individuals leave work, travel and spend on entertainment and housing–and then as an individual slows down, spending begins to decrease until later in retirement when the cost of healthcare and long term care increases and causes overall spending to go up again.

Staying In It to Win It

Even in a choppy or uncertain market, the fundamentals of investing are especially important. When individuals save for retirement based on a sound and comprehensive financial plan the risk of reactionary impulses based on fear is diminished and contributes to post-retirement well being.. This helps individuals to stay invested in the market for the long term, even when the market bounces.

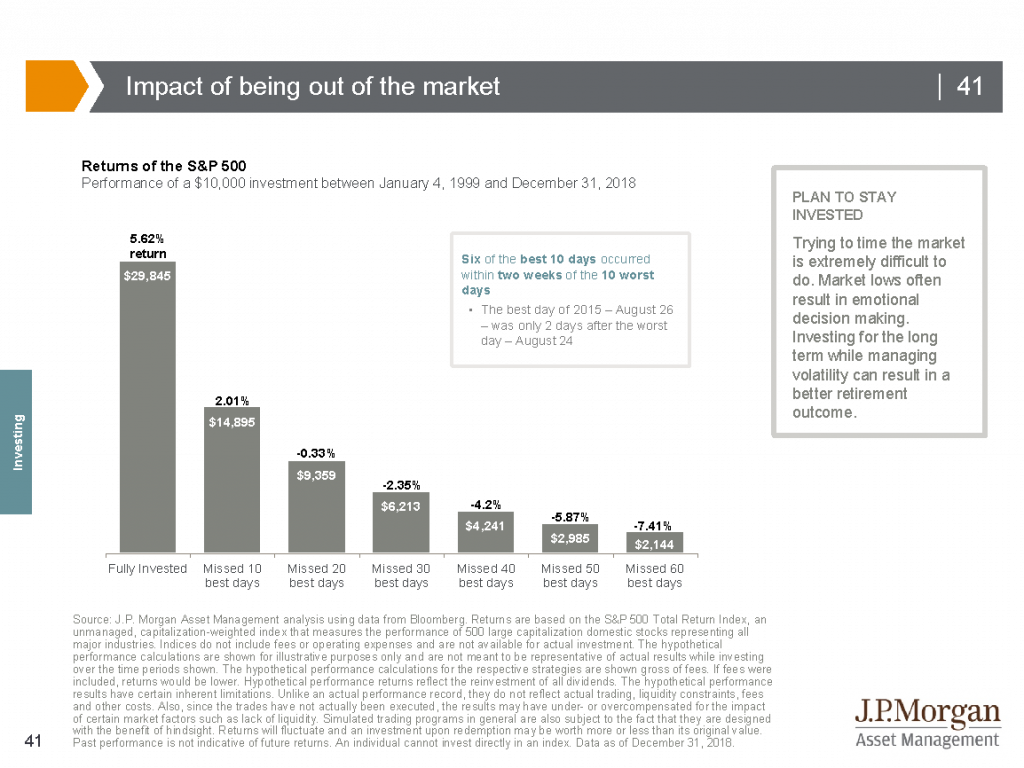

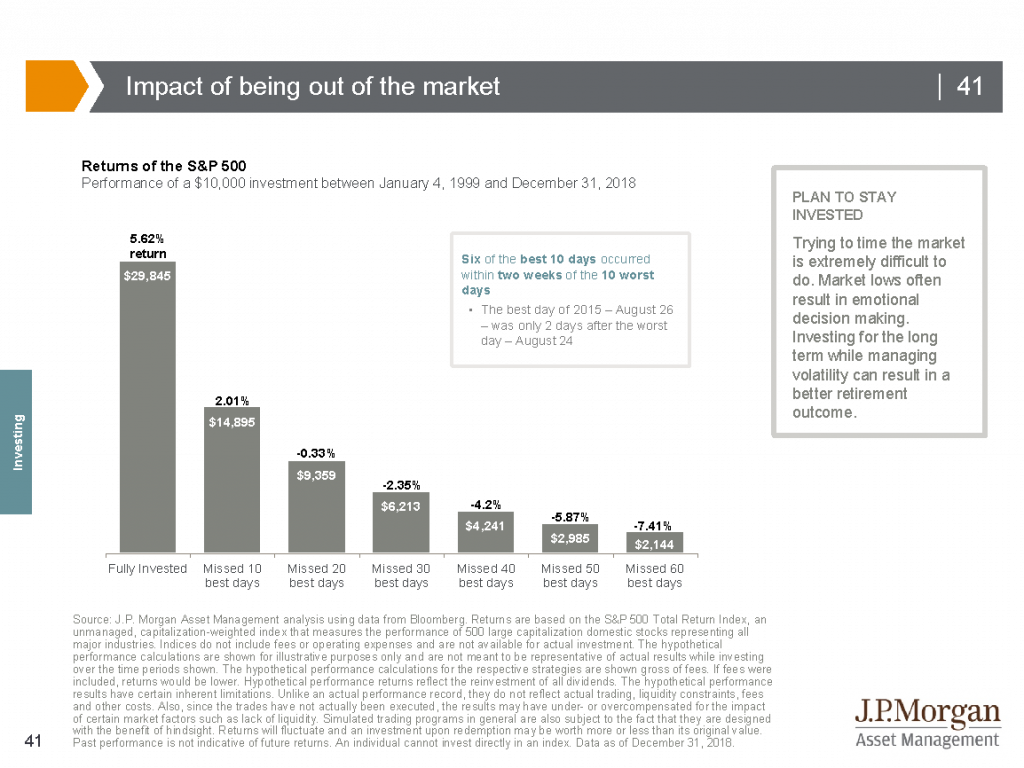

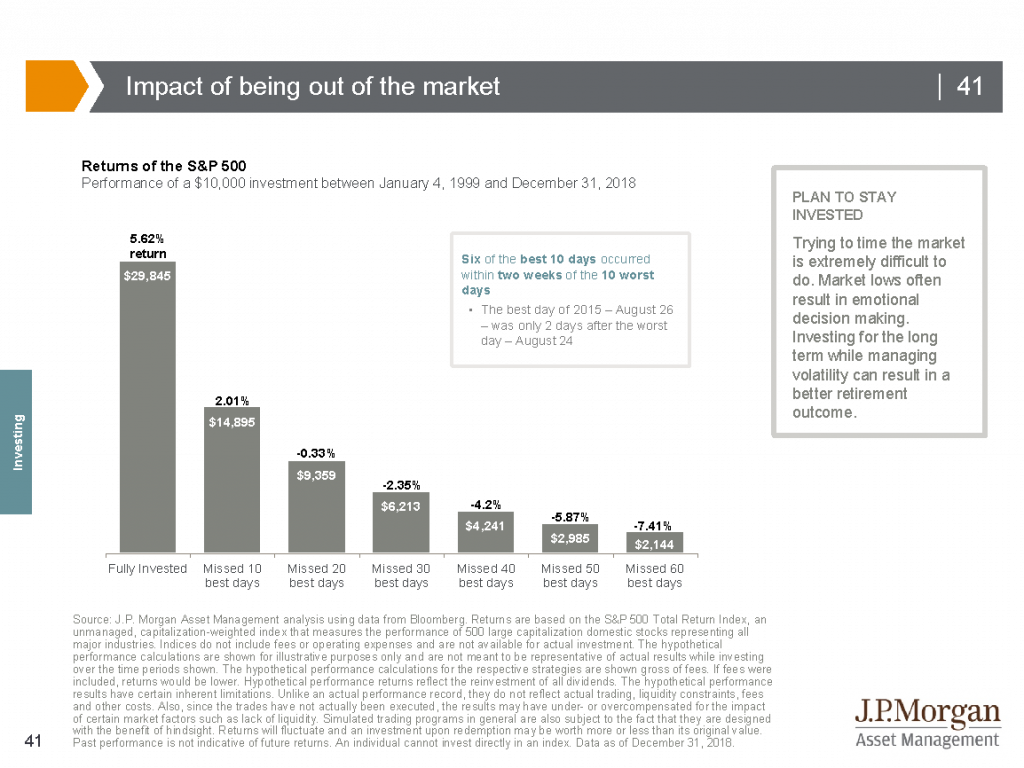

Working with a financial advisor, especially when you are saving and investing outside of IRAs and employer plans is also key; an advisor can help ensure that you’re invested in the appropriate investment strategies according to your short-and long-term goals and risk tolerance. Most important an advisor can help you avoid knee-jerk reactions based on fear caused by the day-to-day market movements. Consider the below JP Morgan chart that details what happens when an investor stays invested in the market over the long term versus an investor who gets out of the market during times of uncertainty. Note that most market rebounds occur within 90 days of a market bottom; the investor who is motivated by fear and gets out could see his returns reduced by more than half.

Overcome a Queasy Stomach

Like roller coasters, the financial markets can be scary and leave an investor with a queasy stomach. The key to managing these times of volatility is to focus on what you can control by maximizing saving including continuing to make contributions to your employer plan, calculating your projected expenses in retirement , understanding how spending may fluctuate and saving towards those goals, working with a financial advisor and staying invested. This may not guarantee a smooth ride, but it can get you closer to the lifestyle you desire in retirement.