Why Value Investing is Attractive to Investors

Published November 2022

Perhaps you’ve been lucky enough to see someone in the airport thumbing through a copy of The Intelligent Investor. While it wasn’t the first book on value investing ever written, its impact on the culture of value has been immense. The snapshot of this book is that if you are dedicated enough to comb through the financial statements of a lot of stocks, you ought to be able to find some that are effectively trading for less than the net assets listed on their balance sheet. We’ll call that “Price to Book” or “P/B,” an essential concept in value investing.

Value investing means trying to buy cheap stocks trading for less than what they are worth. One might compare it to thrift shopping. Sometimes Goodwill has brand new Lululemon Athletica clothes for sale — a deal compared to the price they’re normally sold for in-store. Can the stock market allow for the same type of upside for an enterprising investor?

To take that metaphor a little further, think about TLC’s Extreme Cheapskates dumpster diving in search of “value.” Even reputable value investors have described their strategy as “searching in the trash bin” for performance.

One theoretical explanation of value is “overreaction.” For example, a company (or several) may report bad or shocking news. Perhaps their pension is underfunded, sales are slowing, an unexpected virus is on the loose, or there’s been a change in executive leadership. The market reacts and the stock drops dramatically at price.

A value investor may notice this stock and conduct an objective evaluation of the prospects of the business. The investor might realize that despite the negative news, they still have a strong balance sheet and perhaps even ongoing earning power.

The story here is that the market overreacted. That theme captures a lot of the possibilities of the value approach.

Why is Value Attractive To a Lot of Investors?

Who doesn’t love a bargain? Value is psychologically powerful (“I’m getting things for cheap!”) and backed by university libraries full of research. Some of the most popular are by Eugene Fama & Ken French, who still publish their results on Dartmouth University’s site.

One cannot discuss value without touching on the idea of backtests. A backtest is an after-the-fact “what would have happened” simulation of asset returns that have turned plenty of prudent skeptics into googly-eyed gluttons for higher returns.

The backtests for value are plentiful. Fama & French have data going back to 1926 that’s helped asset managers raise a whole lot of money. If researching Fama-French value investing and you see HML, that stands for “High-Minus-Low” referring to the Price to Book ratio we mentioned earlier.

Sidetrack: “Factors”

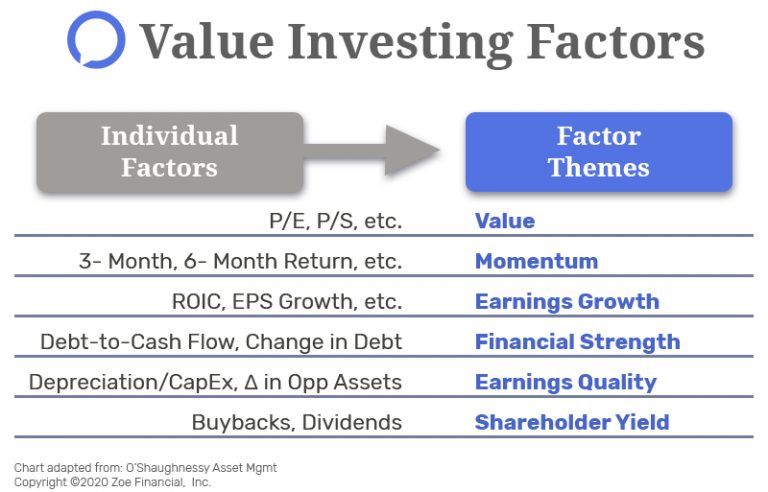

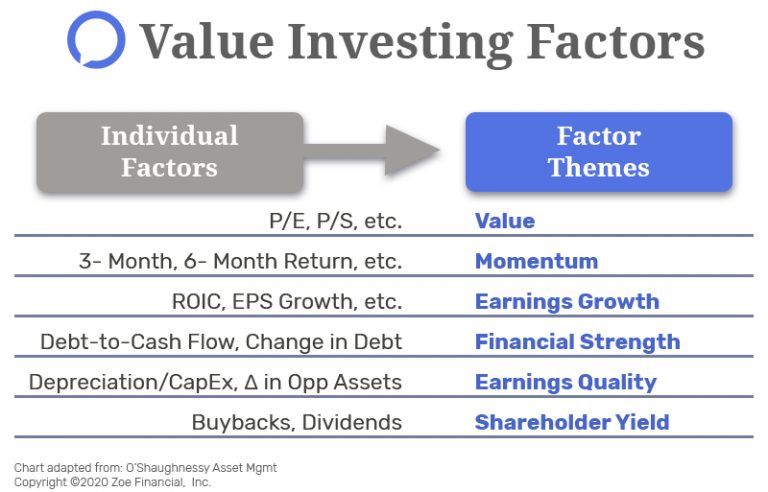

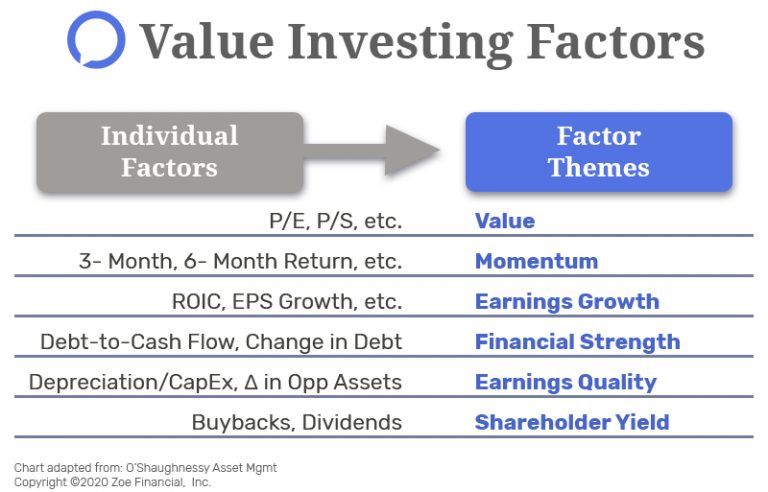

Factor is a word you might start to hear when you’re diving into value investing research. A factor is a data point, like the ratio of a company’s sales to its share price. It’s used to compare many different companies across a single characteristic.

Here’s a handy graphic that helps illustrate factors:

As you can see, “Value” is characterized as a factor theme, a composite of multiple individual data points around a given stock and its financials.

This is an important point because tons of value investing enthusiasts spend hours arguing on the internet about nuanced differences in specific factors. Majority of the time, these factors fall under the “value” umbrella.

What Does Value Bring to the Table?

Theoretically, value investing is likely to increase your stock portfolio’s return, as well as its volatility. Estimates vary widely as to just how much excess return value might give you.

Research Affiliates, who publish a website around factor investing, estimate their value factor to give 4.69% excess return over the large-cap benchmark. Just how they might achieve such precision is impossible to say or predict.

A pure value approach is demonstrated in “The Little Book That Beats The Market” by Joel Greenblatt. Greenblatt estimates somewhere in the mid-teens returns for his concentrated value strategies. Importantly, over the past ten years, it has destroyed investors’ returns, while still hitting them with higher volatility.

What Does Value Investing Mean for a Financial Plan?

Modern financial plans demand inputs around expected returns, volatility, as well as correlations between assets.

An unfortunate reality is that it’s impossible to beat the market and predict returns in advance. We have to do our best given the information currently available.

A combination of value, the insane library of backtests, researchers publishing their work online, and academic focus ultimately gives investors a massive toolbox with which to work.

Ultimately, it comes down to these two notions:

- Higher volatility increases our range of outcomes in the plan

- Higher expected return increases our chances of success in the plan

Weigh those two carefully against one another while considering an allocation to value.

A Financial Planner’s Takeaways on Value Investing

Value investing is a great reminder of the notion of no pain, no gain. Value, unless it is dead, has a place in the prudent planner’s portfolio. Value can shift the efficient frontier with diversification benefits and can also potentially underperform for multiple decades. Different iterations of value might work in different contexts. Ultimately, any planner relying 100% on the value factor to deliver returns for a retirement plan is timing the market for a quick pay-day, instead of focusing on your long-term financial success.

Ready to Get Started?

Real financial planning should pay off today, and in 10 years’ time.