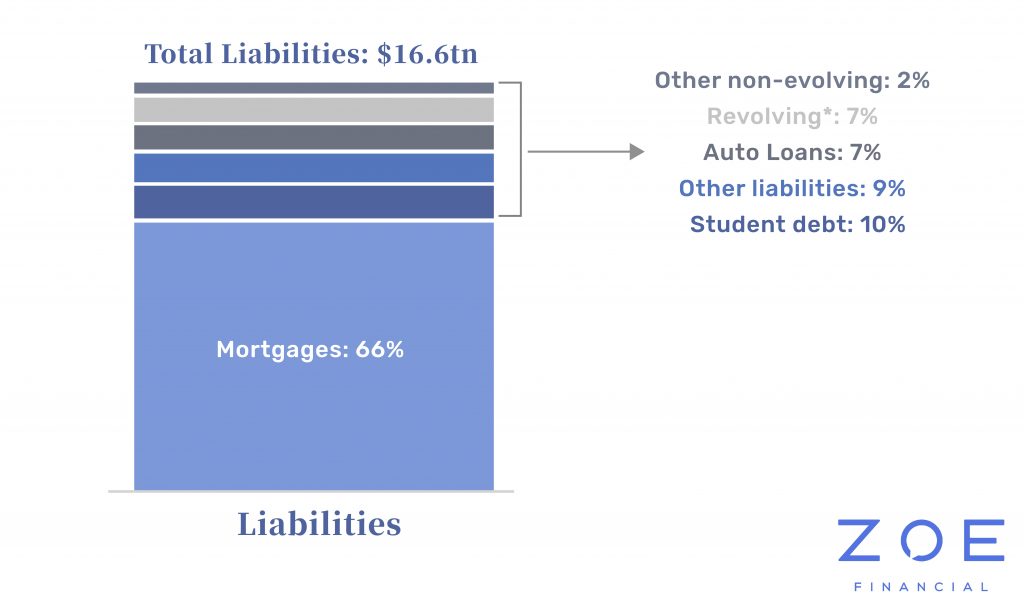

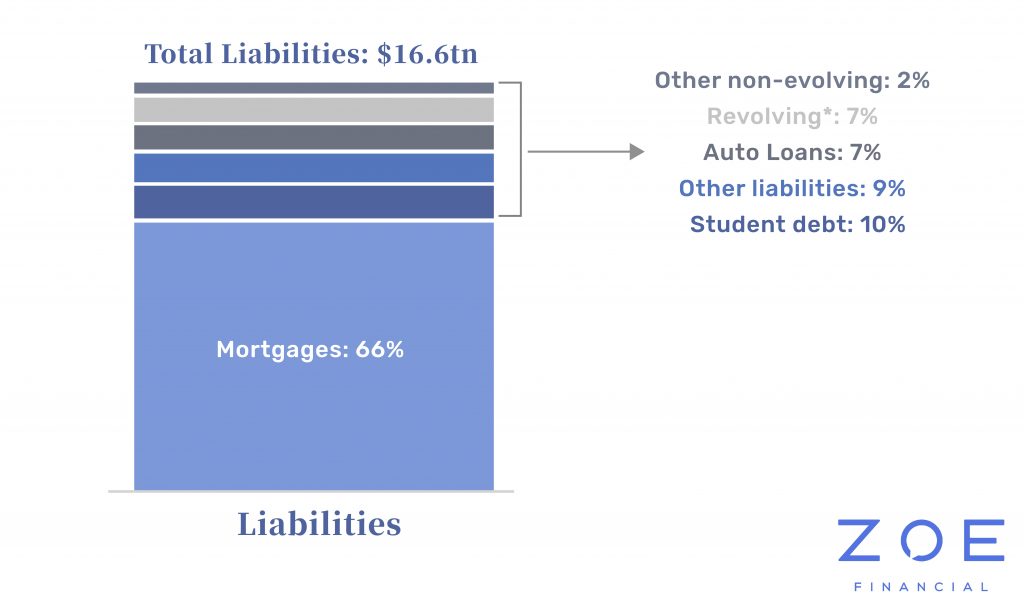

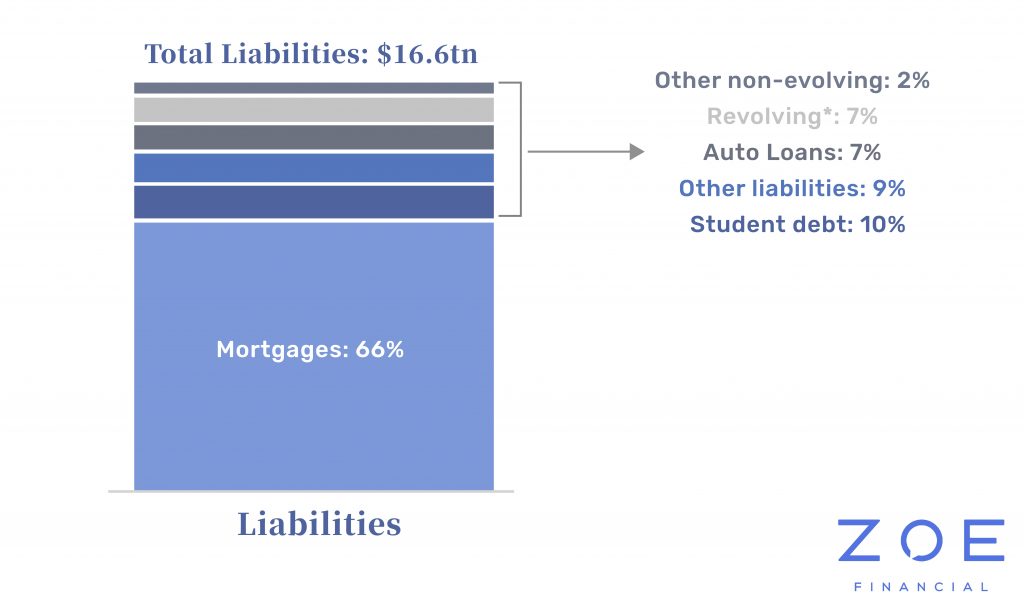

Among Americans between the ages of 36 and 44, the median housing debt is $93,700. Studies show that credit cards and mortgages account for the majority of debt in this age group. Having said that, at the aggregate level, mortgages account for $10.9 Trillion while credit cards account for $1.1 Trillion. As the below chart illustrates, mortgages are 66% of the total liabilities American families owe.

While the mortgage balance may often seem like an onerous burden for many to tackle, the median monthly mortgage payment is actually $1,100, according to the latest American Housing Survey from the U.S. Census Bureau.

Amid a rapidly changing economic landscape following lockdowns, layoffs, and furloughs, millions of Americans are wondering just how they’re going to manage their mortgage payments during such uncertain times. If you’re one of them, then know that you’re not alone. The government is working hard to find solutions for you, especially in terms of mortgage loans.

Before turning to mortgage loans, there are a few other ways in which you can manage your mortgage without accruing more debt, meaning a shorter pay-off period in the long-run.

Refinance Your Mortgage

Refinancing your mortgage makes sense when interest rates are low. Bankrate shows that, in March, refinancing rates dropped to under 4% for 30-year mortgages and close to 3% for 15-year mortgages. If you need a more affordable monthly payment, this option might make sense for you based on your unique financial situation. You’ll be able to build equity faster while reducing your monthly expenses.

A fiduciary financial advisor can help you make sense of your options here, but it’s best to crunch the numbers to ensure that the closing costs of refinancing don’t outweigh any potential long-term savings you might enjoy with current lower interest rates.

Make Sure You’re Not Overpaying

Homeowners spend thousands of dollars in private mortgage insurance (PMI) payments a year. PMI protects a lender in case you default on your primary mortgage. If you were able to pay at least a 20% down payment on your home, you likely don’t have to worry about this. However, if you weren’t able to meet that minimum, your mortgage lender likely required you to take out PMI. If you’ve since paid at least 20% of your home’s value towards the principal amount of the loan then you can contact your lender and request that they remove the PMI. Seeing as it can cost between 0.5% and 1% of the entire loan amount, you can potentially save thousands of dollars by having PMI taken off your loan if you’re eligible to do so.

Think About Prepaying Your Mortgage

If you’re able to do so, it usually makes sense to “prepay” your mortgage, which refers to the act of paying more than your monthly mortgage payment requires you to pay. There are a few benefits to this other than simply paying off your mortgage faster. If you’re able to increase your monthly payments over the amount your lender is requesting, even by $25 or $50 per month, you can save thousands of dollars in interest over the entire life of your mortgage loan.

Again, this is something you’d be better off discussing with a financial advisor as there are factors such as interest rates, the life of your loan, and your tax bracket that affect the overall benefits of prepaying your mortgage. Separately, you might be better off investing that saved money elsewhere, like in high-yield savings accounts or even in an index fund that will earn an overall higher return in the long term.

Extend Your Mortgage Payments

As part of the CARES Act, homeowners with federally-backed loans can receive substantial assistance in terms of managing their mortgage during the coronavirus crisis. Beginning March 18th, 2020, the government blocked any sort of foreclosure proceedings for at least 60 days. On top of that, the CARES Act allows homeowners to defer mortgage payments for an initial 180 days. After the initial 180 days is up, if you still need help managing your mortgage or cannot make payments, you’re eligible to request additional 90-day extensions for a forbearance period for up to a year. The best part? These extensions won’t affect your credit score.

Managing Your Mortgage in a Way That Makes Sense for You

By now you’ve likely realized that there are a lot of variables when it comes to managing your mortgage payments and there’s really no one-size-fits-all answer to what you should do in order to best manage your monthly payments.

That’s why it makes sense to speak with a commission-free financial advisor who’s familiar with your unique situation and specific goals. From learning all about your financial situation to helping you make sense of your options, whether that’s refinancing or prepaying, a fiduciary financial advisor will ensure you’re able to meet your monthly payment requirements while working towards paying off your loan in the most efficient way possible.

Disclosure: This blog is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. The observations of industry trends should not be read as recommendations for stocks or sectors.

Ready to Get Started?

Real financial planning should pay off today, and in 10 years' time.