Sheryl Sandberg’s $24.5 Million Pay Day: A Case Study in RSUs

Reading Time: 7 minutes

Ever wondered how much equity compensation Facebook’s COO has? Sheryl Sandberg’s Restricted Stock Units amount to $24.5 million.

Sheryl Sandberg, Facebook’s Chief Operating Officer, is now very, very rich. Well, even more than she was before. As the second most important person at Facebook after Mark Zuckberg, her latest pay day comes as no surprise. With a steady growth in existing and emerging tech companies, the way companies are paying their employees has transitioned from cash only to a combination of cash and equity awards.

A common compensation form for tech employees like Sandberg is restricted stock units (RSU). While RSUs have the potential to be more beneficial than just cash, they are also a little confusing for employees. Let’s walk through a scenario to better understand what this means.

Restricted Stock Units in Action

Sheryl Sandberg is the COO of Facebook – and has been with the company a little over 12 years! In March 2021, she received an RSU award for 75,526 shares in addition to her cash compensation.

Value:

The shares were granted to her on March 22, 2021. What this means is that she was told about them, but couldn’t really take action on her part yet. Facebook was trading at $324.63 when the shares were granted, so a simple multiplication can help us calculate the value of these shares:

75,526 x $324.63 = $24,518,005.38

After some simple math, it’s easy to see where Sandberg’s 24.5M award comes from! This number is eye boggling as is, but equity compensation is a little more complicated than just receiving a bonus check. There are different factors in play that we need to walk through in order to understand the process of how this compensation is awarded.

Timing:

Every company has a different timeframe for the shares to be vested (meaning when the employee has full rights to the shares). For Facebook specifically, “The RSUs vest quarterly as to 1/16th of the total RSUs, beginning on February 15, 2022, subject to continued service through each vesting date.”

To simplify, these are the three things you need to know in this case: 1) something happens every quarter, 2) she has to stay employed for her to get paid, 3) it starts in one year.

Breaking Down Sandberg’s Restricted Stock Units

On February 15, 2022, Sheryl will get 1/16th of her shares released.

1/16 x 75,526 = 4,720 shares

Think of this event like a bonus payment. Rather than getting a cash deposit, it comes in the form of Facebook stock every quarter. The difference is that with cash, the value of $1 will always be $1. However with stock, the value of 1 share will vary depending on the market and the company performance overall.

Let’s say that in February 2022 (on her first payment) Facebook stock is trading at $350. To calculate the value of her “bonus payment” (the share value she will receive), we can use the same multiplication:

4,720 x $350 = $1,652,000

This means that the value of the company stock when the shares were granted was lower, however, over the following months Facebook stock went up about $25, giving Sheryl a higher value to her shares and her overall compensation.

Big Income, Big Taxes

When a company grants shares, or tells you about them, there are no tax consequences. Tax usually comes into play when money is received, not necessarily when it’s earned. For RSUs, employees will pay tax when the shares vest, meaning when they have full ownership of them.

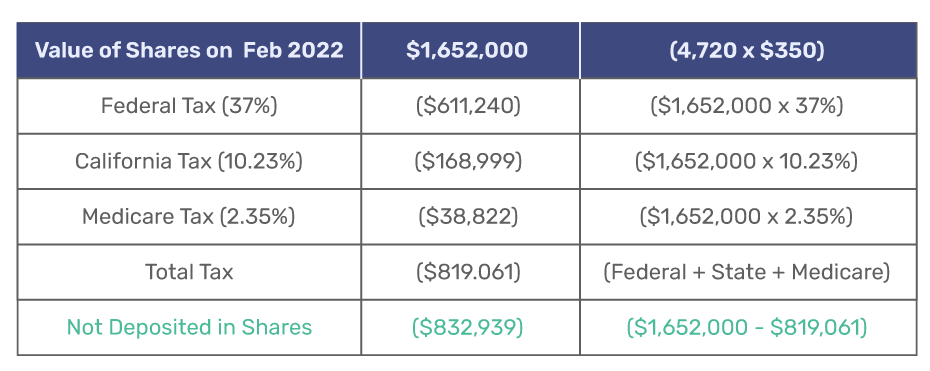

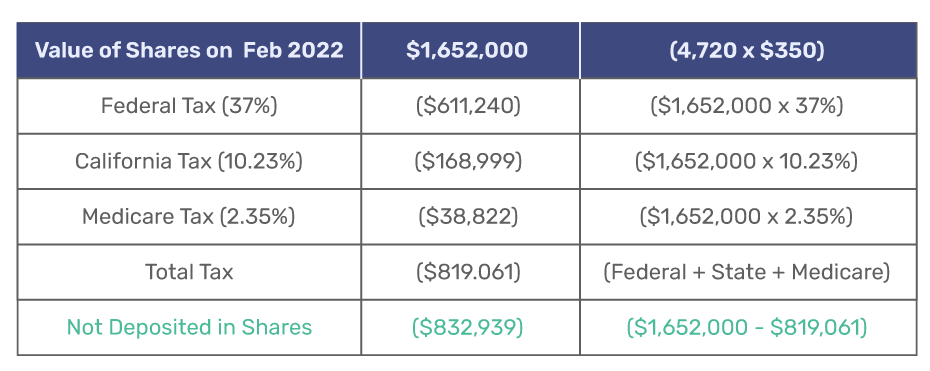

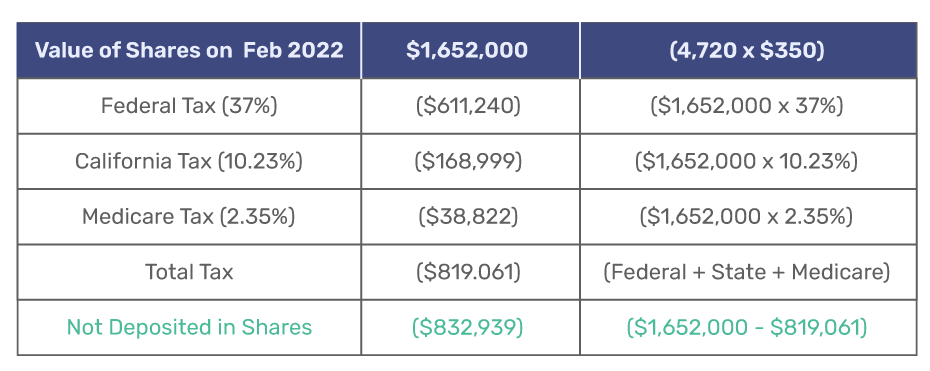

Now in February 2022, Sheryl isn’t going to get $1,652,000 worth of stock deposited into her brokerage account. Similar to a bonus, taxes are going to be withheld from the vesting and the net amount will be deposited in shares. Here’s what’s gonna happen:

A financial advisor can be a huge asset when navigating tax consequences. Most individuals who receive stocks unfortunately have no idea a tax payday is coming. Having an advisor can help explain and strategically plan for this day to ensure you’re prepared.

Why Are RSUs A Good Equity Compensation Option?

Companies give employees RSUs to keep their people’s interest aligned with the business interest. There are two main incentives to this compensation structure.

- If the value of the stock increases, then so does the payout to the employee. This motivates employees to work harder in order to contribute to the business growth. Who doesn’t want to make more money?

- Employee retention. Since the vestings are spread out, usually over years, then employees are more likely to stick around a few more years to get all the shares. For most companies, if an employee quits their job they no longer get the shares that haven’t been vested.

Everything You Need To Know About Restricted Stock Units

Restricted stock units can sound intimidating and messy, but there can be significant value in adding this into a compensation plan. Valuing the shares is tricky since it’s impossible to predict the value of the stock in the future, but this uncertainty might just pay off in higher compensation. This is why the exciting part happens when the shares are actually vested, rather than when they’re granted. An important point to keep in mind is that RSUs are treated just like a cash bonus for tax purposes, so taxes will still take their share like all compensation.

Equity compensation can benefit the business by keeping high performing employees around longer, and benefit the employee by increasing employee pay as a direct reflection of their hard work. When both parties believe in the project and the future of the company and its growth, this form of compensation can be a win-win for everyone.

May you be as lucky with your Restricted Stock Units as Sheryl Sandberg was!

Ready to Grow

Your Wealth?

Let us connect you with the most qualified wealth planners

Ready to Grow Your Wealth?

Let us connect you with the most qualified wealth planners