Advisors, Make Your First Client Impression Count

Reading Time: 6 minutes

Advisors, Make Your First Client Impression Count

Reading Time: 6 minutes

When a prospective client meets you, they should know you’re the right one for them. After listening to thousands of introductory calls, here are our best practices for more successful introductory meetings.

Remember how parents used to say that the first impression matters most? Some truths stand the test of time. Far too many advisors miss out on the opportunity to make a great first impression with potential clients, ultimately leading them to lose out on new business.

On average, clients meet with three advisors before making the final decision of which one to hire. That’s why it’s important to make the best first impression you can. When a prospective client meets you, they should know you’re the right one for them.

A great way to ensure the success of introductory meetings is having a process that you can iterate over time. After listening to thousands of introductory calls, here are our best practices for more successful introductory meetings.

1. Start Off On The Right Foot With a Quick Intro

The easiest, yet most meaningful, thing you can do is show up on time to the meeting. Whether it is over the phone, on Zoom, or in person, you should never keep the client waiting. Once you’re there, the meeting starts with an introduction. During the first 2 to 3 minutes (max), tell the client who you are, as a person and as an advisor, while also mentioning what makes you and your firm unique.

Start with your name and qualifications. You can even educate them a bit – you spent so much time preparing as a financial advisor to be here with them, it’s worth making sure that they understand what those qualifications mean. That said, the idea is not to bore the client, so keep it brief and simple.

Next, share your why. Tell them why you’re passionate about financial planning and why you’re looking to help them. Yes, they want to know that! It will automatically generate interest and a connection with your client because they will see you as a person rather than as a robot that is there to offer them a service. Use this brief moment to make yourself memorable to them by sharing a detail about your life, such as your pet’s name or the age of your children.

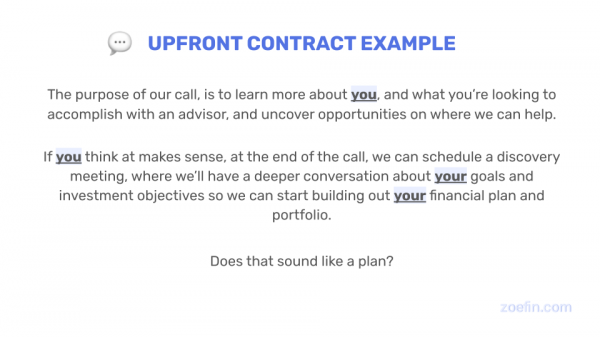

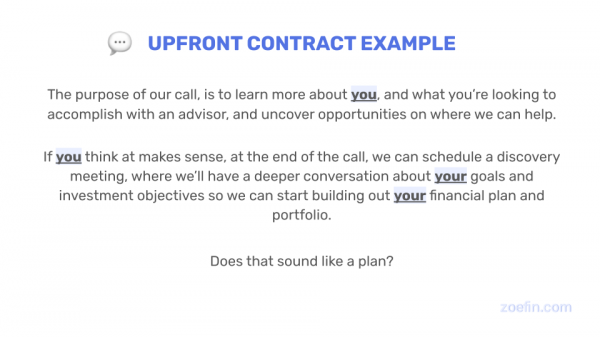

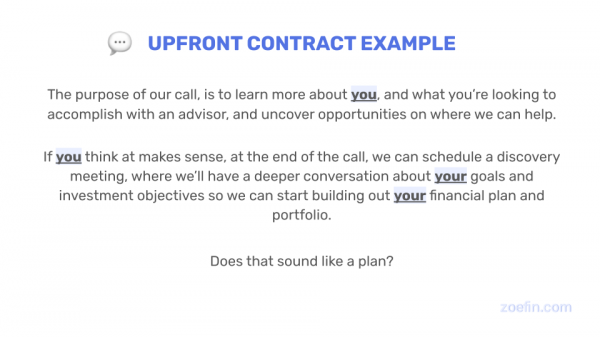

2. Upfront Contract: Set Clear Expectations For Both Parties

Once the client knows who you are, lay out the expectations. Let’s be honest: your time is valuable. Make sure they understand what is going to happen during this meeting and what they can expect to happen after. It is key for you to use “you” and “we”, instead of “I” language. This will reinforce that your focus is the client and portray the client-advisor relationship as a team.

During this moment, you should aim for the first yes from the client. Tell them the purpose of the introductory meeting and that, if everything goes right, you expect the next step to be a discovery meeting. Ask them if they agree with that plan and get that first yes. Every single yes you get throughout the meeting will lead to your desired outcome of them committing at the end.

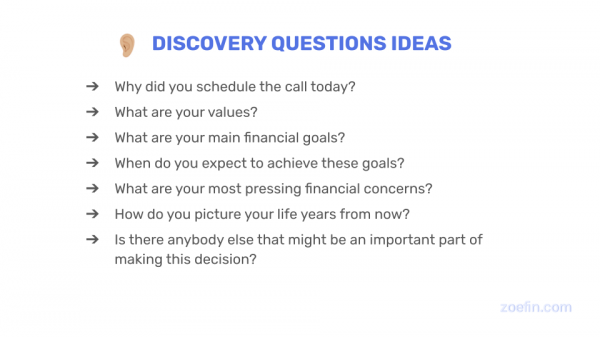

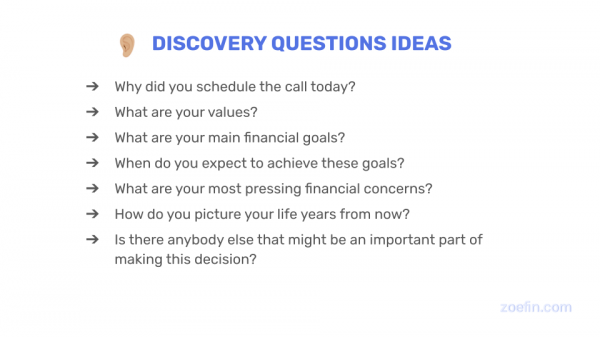

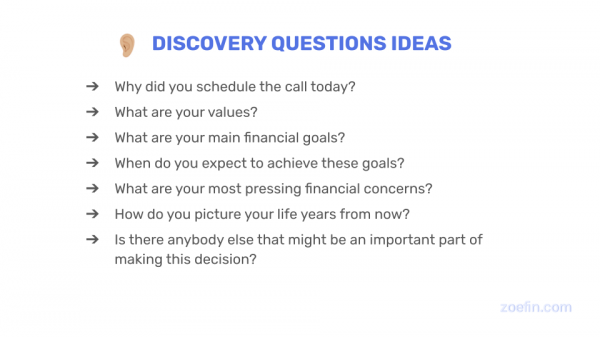

3. Discovery: Make It All About Them

Now, you’re approaching the most valuable part of the meeting: your client sharing their story. This is where you should shine. Learn about their finances, where their pain points are, and identify where you can add the most value – a piece of cake for Zoe Advisors! Make sure to ask all the discovery questions you consider relevant to deeply understand their current situation and their catalyst to look for a financial advisor.

Pay close attention to all they say and even take notes if you consider it helpful. If you do so, make sure to maintain eye contact every now and then so that they know they’re being listened to. Keep in mind that this moment is all theirs so whatever great ideas occur while they’re talking, write them down and find a later moment to voice them. For now, focus on asking questions and listening. Always keep in mind that if this meeting was a game, whoever talks less is the winner.

4. Repeat Back: Increase The Engagement

The client just shared information with you that they probably don’t share very often. Some people don’t even share financial information with the people closest to them! Ensure they know you actively listened to everything they said to show you care. The best way to do so is by repeating what you learned. In fact, this generates an effect that psychologists refer to as The Echo Effect, which states that verbal mimicry reduces social distance and increases engagement in a conversation. This moment of the meeting is a game-changer and will raise empathy in the room.

By doing a recap of what you learned from what your client just said, you will strengthen the connection between you two. Plus, it’ll be a great way to double-check that you are indeed covering every part of the context that they consider relevant to the situation.

At this point, you could even bring the second yes into play. Ask them if you got the recap right and you most likely will receive a sigh of relief accompanied by a “yes, exactly!” You’ll then know that your client is thinking “it’s great talking to someone who seems to get it.”

5. Address Pain Points: Show Them You’re The Right Fit

While showing your prospective client that you’re listening is crucial, it is also key you share how your firm can help them address their issues and concerns. Show them in a clear and simple way how your expertise could be helpful for them. Consider providing a few examples of previous clients with similar pain points and briefly tell them how things turned out for them after you helped them. Doing so will make them feel understood and let them know that you actually know what you’re dealing with.

At this point, the prospective client wants to know if they can trust you with their issues and if you will effectively use your training and experience to help them achieve their goals. That’s your cue to get the third yes. Get confirmation from them with something like “does this sound like what you’re looking for?” It will make them feel included and bring you closer to being hired.

6. Set Next Steps: Take It To The Next Level

Finally, it’s time to wrap up. These few minutes will be decisive for what will happen next. If you want to increase the chances of having the client commit, don’t leave the next steps open: make sure to get an answer at the end of the meeting.

There are three main things for you to keep in mind at this point. First, time kills deals, so be sure to set the discovery meetings within a week of the initial call. Second, a straight “no” is almost as good as a “yes” and saves valuable time for you, so if that’s the answer you get, it’s better than no answer at all. Third, you must give the clients the sense that they are in full control of the situation. A great approach to do this is what we call the rule of two: give them two time slot options and ask which one works best for them. This will likely improve your chances of getting a second meeting scheduled by the time the meeting is over.

The introductory meeting is challenging, no doubt. Advisors often say it’s a thin line between using this meeting to get the ball rolling and sounding too pushy. The truth is, you deserve to know where you stand with each prospective client you speak with. Being warmly assertive is a great way to get a response without making the client feel uncomfortable. Use these best practices to address each part of the introductory meeting in a way that gets you a yes that keeps the conversation going and builds towards the final commitment.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.