Game, Set, Tax

In this article: Discover if you’re part of the “Sandwich Generation” and learn the top six financial planning tips to ensure you’re prepared for the future, regardless of your potential financial burdens.

Published Jun. 5, 2017

Reading Time: 5 minutes.

Monday saw the first round of Wimbledon get off to a dazzling start with the favorites, Roger Federer and Rafael Nadal, cruising through their first matches. Steeped in tradition, Wimbledon is one of the most important Grand Slams for these tennis superstars. Although Fed is, of course, the undisputed grass court champion with 7 Wimbledon titles, 2 of Rafa’s 14 titles have been won on grass and he is always a threat to Fed – no matter the surface. They have one of the fiercest and longest-lasting rivalries in tennis history.

Rafa’s on-court aggression is juxtaposed against his polite off-court demeanor and he has seldom appeared in the media for anything other than his grand slam records or huge guns. However, in the buildup to Wimbledon, he mentioned that he has found it “increasingly difficult” to play in the Queen’s Club Championship, the London-based grass court tournament that is somewhat of a curtain-raiser to Wimbledon. By “difficult” he means financially – specifically referring to the tax laws in the United Kingdom for non-resident individual professional athletes.

Tax Laws

In the UK, the tax laws for appearance fees and prize money are similar to the US – you pay tax on whatever you make whilst in the UK (which can normally be deducted from your taxable income in your country of residence). So when tennis stars play in tournaments in the UK, they pay 45% tax on appearance fees and winnings. But it’s not really a big deal as it’s practiced around the world.

What is NOT normal, is that Her Majesty’s Revenue and Customs (HMRC) also taxes players on their endorsement income, something that is not common in many countries. And that’s where it gets messy.

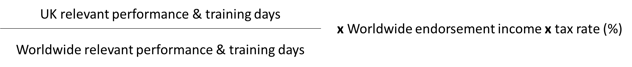

The UK endorsement income tax works like this: the total value of a player’s worldwide endorsement deals is apportioned to the period of time that the player trains and performs in the UK. The endorsement tax a player pays is calculated as follows:

We have similar laws here in the US for non-athletes too, where if you live in one state but “work” in another, you could end up paying income tax for multiple states. If you’re a professional athlete, or just happen to work in a number of different states, you could end up having a pretty complicated tax situation (which is often contested in court by top athletes).

Do you travel to other states throughout the year? Speak to a tax planner that can save you time and money. to speak to tax planner that can save you time and money. Click Here To Book Time.

Rafa, who won at Queen’s in 2008 and had played there every year from 2006 to 2011, chose not to compete in 2012 for financial reasons. Was he being ridiculous foregoing the $450,000 on offer for the winner? Or is this rule really something that players need to consider when deciding on their schedule?

Take A Closer Look…

The UK hosts many of the sport’s grass court tournaments and the grass season for super pros like Rafa often includes a build-up tournament (Queen’s for example) followed by Wimbledon. And then at the end of the year, the top 8 players in the world return to the UK (sans grass) for the ATP Tour Finals at the London O2 Arena. So, the average amount of time spent in the UK for someone like Rafa is about 6 weeks (2 weeks per tournament).

Rafa’s endorsement income is estimated at about $28 million per year, although exact figures are hard to find for confidentiality reasons. Let’s reduce that to $20million to make the math easier and to make sure we’re not over-valuing him.

In the interest of simplicity, let’s assume that Rafa plays an average of 7 matches per tournament (which would get him to the final of each tournament) and trains for 3 days in between matches. So, in total, he performs and trains for 10 days and therefore has to pay endorsement tax for these 10 days at each tournament, on top of any income tax on prize money.

Let’s have a look at each tournament and assume he wins each i.e. earns maximum prize money – detailed explanations are available at the end of the blog should you wish to see the entire calculation*:

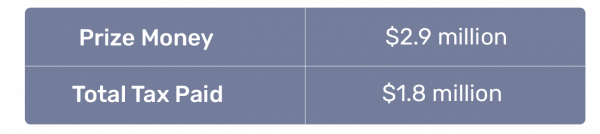

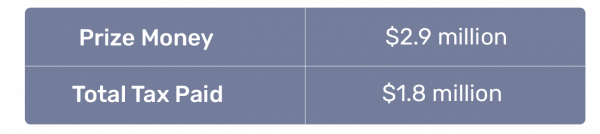

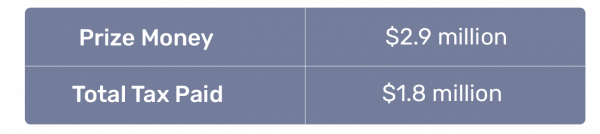

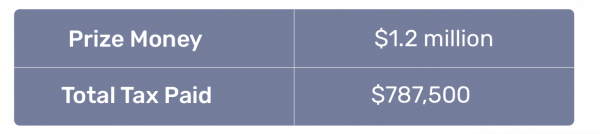

Wimbledon:

If Rafa won Wimbledon and was handed a check for $2.9million, he would walk away with $1.1million after income and endorsement tax. Well, that’s not so bad! He pockets 38% of the prize money.

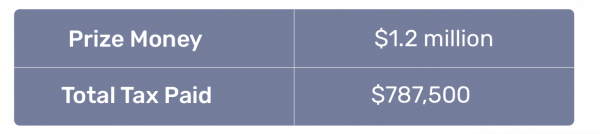

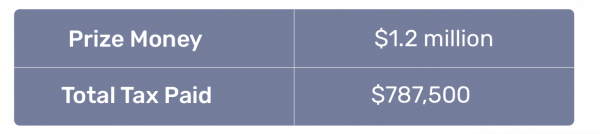

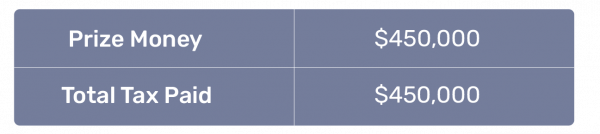

ATP Masters Final:

At the end of the tournament, after income and endorsement tax Rafa nets $412,500. His percentage hasn’t dropped too much, at 34% of the total prize money. It a much smaller sum but still a decent takeaway.

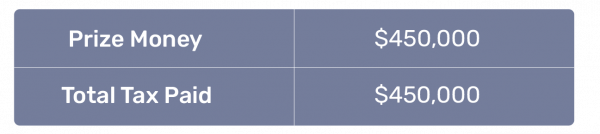

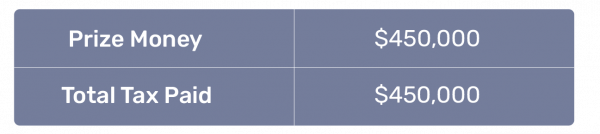

The Championship Of The Queen:

Rafa walks away with ZERO after winning the tournament. He pays the total prize money of $450,000 in tax. Now that is ridiculous!

If Rafa played in all three tournaments – and won them all – his net take home would be $1.512 million in the UK, and for the same winnings in a country without the endorsement tax law, they would be $2.255 million – a pretty substantial difference I would say.

And remember that is if Rafa WINS each of these tournaments. If he were to earn less prize money, his income tax would decrease but his endorsement tax would remain the same, reducing his margin even further.

Now, of course, many of these tournaments offer more than just the prize money, and for someone like Rafa, who has won 15 Grand Slams, money isn’t exactly tight. But athletes naturally have shorter careers than us normal folk, so it is important to make wise financial decisions. And in this case, it may mean prioritizing tournaments outside of the UK (a much safer option than Messi chose, which has put him in a bit of a pickle!).

Conclusion

As the media around this issue has increased, and big names have started to think a bit more carefully about which tournaments to play in (both financially and physically) HMRC has apparently discussed changing the tax law and focusing their attention on charging players for image rights. Now, whether that call is challenged remains to be seen. Ultimately there is a lot more off-court influence than we often realize. It’s going to be very interesting to see if Fed and Nadal’s scheduling tactics work – who knows, we could see another Federer-Nadal final. Epic.

Disclosure: This material provided by Zoe Financial is for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Zoe Financial is not an accounting firm- clients and prospective clients should consult with their tax professional regarding their specific tax situation. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Zoe Financial, however, cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source.

Ready to Get Started?

Real financial planning should pay off today. Not in 10 years time